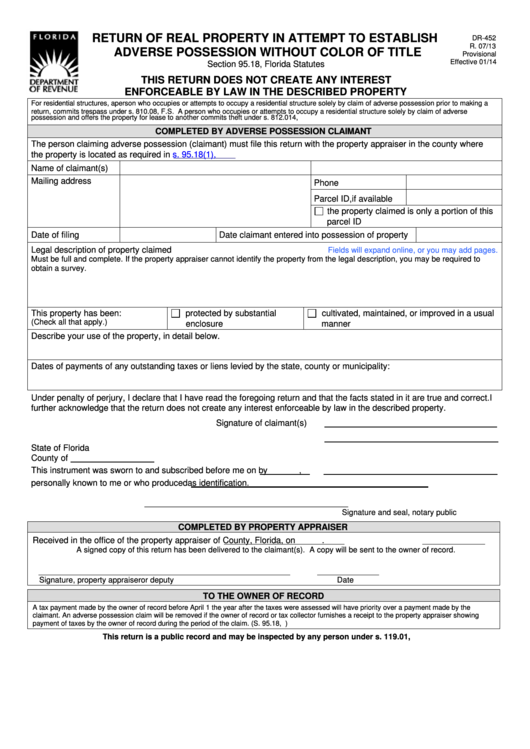

RETURN OF REAL PROPERTY IN ATTEMPT TO ESTABLISH

DR-452

R. 07/13

ADVERSE POSSESSION WITHOUT COLOR OF TITLE

Provisional

Effective 01/14

Section 95.18, Florida Statutes

THIS RETURN DOES NOT CREATE ANY INTEREST

ENFORCEABLE BY LAW IN THE DESCRIBED PROPERTY

For residential structures, a person who occupies or attempts to occupy a residential structure solely by claim of adverse possession prior to making a

return, commits trespass under s. 810.08, F.S. A person who occupies or attempts to occupy a residential structure solely by claim of adverse

possession and offers the property for lease to another commits theft under s. 812.014, F.S.

COMPLETED BY ADVERSE POSSESSION CLAIMANT

The person claiming adverse possession (claimant) must file this return with the property appraiser in the county where

the property is located as required in

s. 95.18(1), F.S.

Name of claimant(s)

Mailing address

Phone

Parcel ID, if available

the property claimed is only a portion of this

parcel ID

Date of filing

Date claimant entered into possession of property

Legal description of property claimed

Fields will expand online, or you may add pages.

Must be full and complete. If the property appraiser cannot identify the property from the legal description, you may be required to

obtain a survey.

This property has been:

protected by substantial

cultivated, maintained, or improved in a usual

(Check all that apply.)

enclosure

manner

Describe your use of the property, in detail below.

Dates of payments of any outstanding taxes or liens levied by the state, county or municipality:

Under penalty of perjury, I declare that I have read the foregoing return and that the facts stated in it are true and correct. I

further acknowledge that the return does not create any interest enforceable by law in the described property.

Signature of claimant(s)

State of Florida

County of

This instrument was sworn to and subscribed before me on

by

,

personally known to me or who produced

as identification.

___________________________________________

Signature and seal, notary public

COMPLETED BY PROPERTY APPRAISER

Received in the office of the property appraiser of

County, Florida, on

.

A signed copy of this return has been delivered to the claimant(s). A copy will be sent to the owner of record.

Signature, property appraiser or deputy

Date

TO THE OWNER OF RECORD

A tax payment made by the owner of record before April 1 the year after the taxes were assessed will have priority over a payment made by the

claimant. An adverse possession claim will be removed if the owner of record or tax collector furnishes a receipt to the property appraiser showing

payment of taxes by the owner of record during the period of the claim. (S. 95.18, F.S.)

This return is a public record and may be inspected by any person under s. 119.01, F.S.

1

1