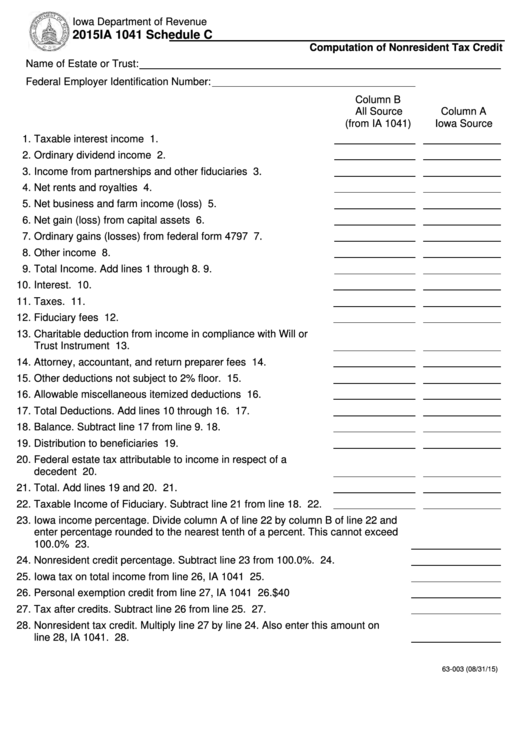

Iowa Department of Revenue

2015 IA 1041 Schedule C

https://tax.iowa.gov

Computation of Nonresident Tax Credit

Name of Estate or Trust:

Federal Employer Identification Number:

Column B

All Source

Column A

(from IA 1041)

Iowa Source

1. Taxable interest income .............................................................. 1.

2. Ordinary dividend income ........................................................... 2.

3. Income from partnerships and other fiduciaries .......................... 3.

4. Net rents and royalties ................................................................ 4.

5. Net business and farm income (loss) .......................................... 5.

6. Net gain (loss) from capital assets .............................................. 6.

7. Ordinary gains (losses) from federal form 4797 .......................... 7.

8. Other income .............................................................................. 8.

9. Total Income. Add lines 1 through 8............................................ 9.

10. Interest. .................................................................................... 10.

11. Taxes. ...................................................................................... 11.

12. Fiduciary fees ........................................................................... 12.

13. Charitable deduction from income in compliance with Will or

Trust Instrument ....................................................................... 13.

14. Attorney, accountant, and return preparer fees ........................ 14.

15. Other deductions not subject to 2% floor. ................................ 15.

16. Allowable miscellaneous itemized deductions ......................... 16.

17. Total Deductions. Add lines 10 through 16. ............................. 17.

18. Balance. Subtract line 17 from line 9........................................ 18.

19. Distribution to beneficiaries ...................................................... 19.

20. Federal estate tax attributable to income in respect of a

decedent .................................................................................. 20.

21. Total. Add lines 19 and 20. ...................................................... 21.

22. Taxable Income of Fiduciary. Subtract line 21 from line 18. ..... 22.

23. Iowa income percentage. Divide column A of line 22 by column B of line 22 and

enter percentage rounded to the nearest tenth of a percent. This cannot exceed

100.0% ................................................................................................................ 23.

24. Nonresident credit percentage. Subtract line 23 from 100.0%. ........................... 24.

25. Iowa tax on total income from line 26, IA 1041 ................................................... 25.

26. Personal exemption credit from line 27, IA 1041 ................................................. 26.

$40

27. Tax after credits. Subtract line 26 from line 25. ................................................... 27.

28. Nonresident tax credit. Multiply line 27 by line 24. Also enter this amount on

line 28, IA 1041. .................................................................................................. 28.

63-003 (08/31/15)

1

1