Form Ct-639 - Minimum Wage Reimbursement Credit - 2014

ADVERTISEMENT

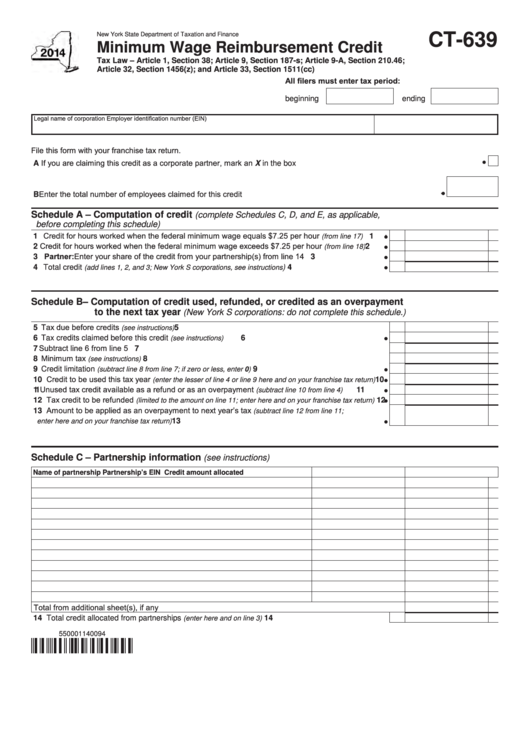

New York State Department of Taxation and Finance

CT-639

Minimum Wage Reimbursement Credit

Tax Law – Article 1, Section 38; Article 9, Section 187-s; Article 9-A, Section 210.46;

Article 32, Section 1456(z); and Article 33, Section 1511(cc)

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number (EIN)

File this form with your franchise tax return.

A If you are claiming this credit as a corporate partner, mark an X in the box ...................................................................................

B Enter the total number of employees claimed for this credit .........................................................................................

Schedule A – Computation of credit

(complete Schedules C, D, and E, as applicable,

before completing this schedule)

1 Credit for hours worked when the federal minimum wage equals $7.25 per hour

........

1

(from line 17)

2 Credit for hours worked when the federal minimum wage exceeds $7.25 per hour

.......

2

(from line 18)

3 Partner: Enter your share of the credit from your partnership(s) from line 14 ..................................

3

) ............................................

4 Total credit

4

(add lines 1, 2, and 3; New York S corporations, see instructions

Schedule B – Computation of credit used, refunded, or credited as an overpayment

to the next tax year

(New York S corporations: do not complete this schedule.)

5 Tax due before credits

................................................................................................

5

(see instructions)

.......................................................................

6 Tax credits claimed before this credit

6

(see instructions)

7 Subtract line 6 from line 5 ....................................................................................................................

7

8 Minimum tax

...............................................................................................................

8

(see instructions)

..........................................................

9 Credit limitation

9

(subtract line 8 from line 7; if zero or less, enter 0)

10 Credit to be used this tax year

.....

10

(enter the lesser of line 4 or line 9 here and on your franchise tax return)

11 Unused tax credit available as a refund or as an overpayment

................

11

(subtract line 10 from line 4)

12 Tax credit to be refunded

.....

12

(limited to the amount on line 11; enter here and on your franchise tax return)

13 Amount to be applied as an overpayment to next year’s tax

(subtract line 12 from line 11;

...........................................................................................

13

enter here and on your franchise tax return)

Schedule C – Partnership information

(see instructions)

Name of partnership

Partnership’s EIN

Credit amount allocated

Total from additional sheet(s), if any ................................................................................................................

.......................................................... 14

14 Total credit allocated from partnerships

(enter here and on line 3)

550001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3