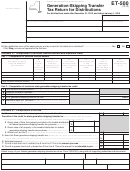

Form Et-500 - Generation-Skipping Transfer Tax Return For Distributions Page 4

ADVERTISEMENT

Page 4 of 4 ET-500 (3/14)

Privacy notification

Column G – Multiply column E by column F to compute the tentative

transfer amount for each distribution, and total the column. Enter the

New York State Law requires all government agencies that maintain

total here and on Part 2, line A.

a system of records to provide notification of the legal authority for

any request, the principal purpose(s) for which the information is to be

Note: If there were transfers after 2003, New York State GST tax may

collected, and where it will be maintained. To view this information, visit

be due even if no federal GST tax was due.

our Web site, or, if you do not have Internet access, call and request

Publication 54, Privacy Notification. See Need help? for the Web

Part 2 – Computation of maximum state

address and telephone number.

generation-skipping transfer tax credit

Line B – Enter the amount of adjusted allowable expenses. Adjusted

allowable expenses are the total allowable expenses multiplied by the

Need help?

inclusion ratio from Schedule A, Part 1, column E.

Visit our Web site at

If there is more than one inclusion ratio in Schedule A, Part 1,

• get information and manage your taxes online

column E, prorate the total expenses among the inclusion ratio based

• check for new online services and features

on the relative value of each distribution made at the various ratios.

Example:

Telephone assistance

1. Value of distribution = $10,000; inclusion ratio = .25

Estate Tax Information Center:

(518) 457-5387

2. Value of distribution = $20,000; inclusion ratio = .33

3. Value of distribution = $30,000; inclusion ratio = .50

To order forms and publications:

(518) 457-5431

Preparer’s fee = $200

Text Telephone (TTY) Hotline (for persons with

hearing and speech disabilities using a TTY): (518) 485-5082

1. $10,000/$60,000 × $200 = 33.33 × .25 = $8

2. $20,000/$60,000 × $200 = 66.67 × .33 = $22

Persons with disabilities: In compliance with the

Americans with Disabilities Act, we will ensure that our

3. $30,000/$60,000 × $200 = 100 × .50 = $50

lobbies, offices, meeting rooms, and other facilities are

Adjusted allowable expense = (8 + 22 + 50) = $80

accessible to persons with disabilities. If you have questions about

special accommodations for persons with disabilities, call the

information center.

Schedule B – Computation of tax due

Line 1 – Enter the maximum state GST tax credit from Schedule A,

Part 2, line E. If the taxable distribution from the trust is wholly from

New York property (see definition below), skip lines 2, 3, and 4 and

enter the amount from line 1 on line 5.

Line 2 – If the taxable distribution from the trust included non-New York

property, enter the value (on the date of distribution) of the New York

property included in the distribution.

The term New York property includes real property and tangible

personal property having a physical location in New York State and

intangible personal property within the state employed in carrying on a

trade, business, or occupation in New York State, that was transferred

by the original transferor. New York property also includes all intangible

personal property transferred by the original transferor, if the transferor

was a resident of New York State at the time of the transfer of the

property to the trust.

Line 3 – If an entry was made on line 2, enter the value (on the date of

distribution) of all property included in the generation-skipping transfer

from the trust to the skip person distributee, including the value of the

New York property.

Line 6 – Enter the amount of any estimated payments.

Paid preparer’s responsibilities

Under the law, all paid preparers must sign and complete the paid

preparer section of the return. Paid preparers may be subject to civil

and/or criminal sanctions if they fail to complete this section in full.

When completing this section, you must enter your New York tax

preparer registration identification number (NYTPRIN) if you are

required to have one. Also, you must enter your federal preparer tax

identification number (PTIN) if you have one; if not, you must enter your

social security number.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4