Form Ct-634 - Empire State Jobs Retention Program Credit - 2014

ADVERTISEMENT

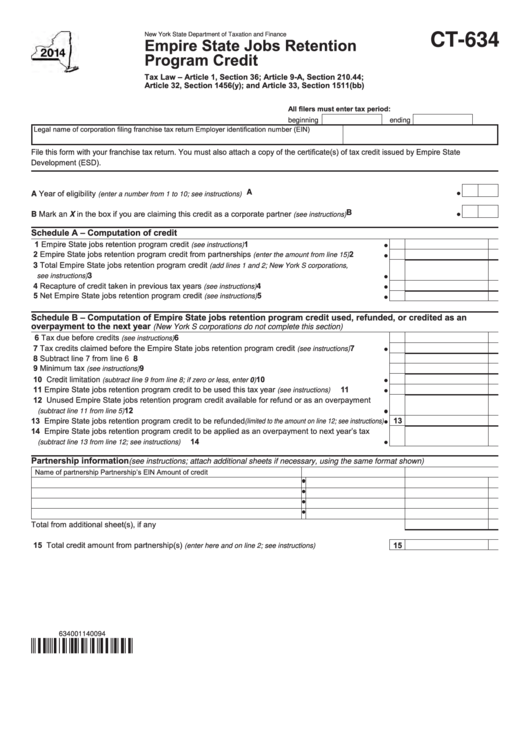

New York State Department of Taxation and Finance

CT-634

Empire State Jobs Retention

Program Credit

Tax Law – Article 1, Section 36; Article 9-A, Section 210.44;

Article 32, Section 1456(y); and Article 33, Section 1511(bb)

All filers must enter tax period:

beginning

ending

Legal name of corporation filing franchise tax return

Employer identification number (EIN)

File this form with your franchise tax return. You must also attach a copy of the certificate(s) of tax credit issued by Empire State

Development (ESD).

........................................................................................

A Year of eligibility

A

(enter a number from 1 to 10; see instructions)

............................................

B Mark an X in the box if you are claiming this credit as a corporate partner

B

(see instructions)

Schedule A – Computation of credit

1 Empire State jobs retention program credit

...............................................................

1

(see instructions)

2 Empire State jobs retention program credit from partnerships

..............

2

(enter the amount from line 15)

3 Total Empire State jobs retention program credit

(add lines 1 and 2; New York S corporations,

.................................................................................................................................

3

see instructions)

4 Recapture of credit taken in previous tax years

........................................................

4

(see instructions)

5 Net Empire State jobs retention program credit

........................................................

5

(see instructions)

Schedule B – Computation of Empire State jobs retention program credit used, refunded, or credited as an

overpayment to the next year

(New York S corporations do not complete this section)

6 Tax due before credits

.................................................................................................

6

(see instructions)

7 Tax credits claimed before the Empire State jobs retention program credit

..............

7

(see instructions)

8 Subtract line 7 from line 6 .....................................................................................................................

8

9 Minimum tax

9

................................................................................................................

(see instructions)

10 Credit limitation

...........................................................

10

(subtract line 9 from line 8; if zero or less, enter 0)

11 Empire State jobs retention program credit to be used this tax year

11

........................

(see instructions)

12 Unused Empire State jobs retention program credit available for refund or as an overpayment

12

.................................................................................................................

(subtract line 11 from line 5)

13 Empire State jobs retention program credit to be refunded

13

(limited to the amount on line 12; see instructions)

14 Empire State jobs retention program credit to be applied as an overpayment to next year’s tax

14

.......................................................................................

(subtract line 13 from line 12; see instructions)

Partnership information

(see instructions; attach additional sheets if necessary, using the same format shown)

Name of partnership

Partnership’s EIN

Amount of credit

Total from additional sheet(s), if any ..................................................................................................................

15 Total credit amount from partnership(s)

................................... 15

(enter here and on line 2; see instructions)

634001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1