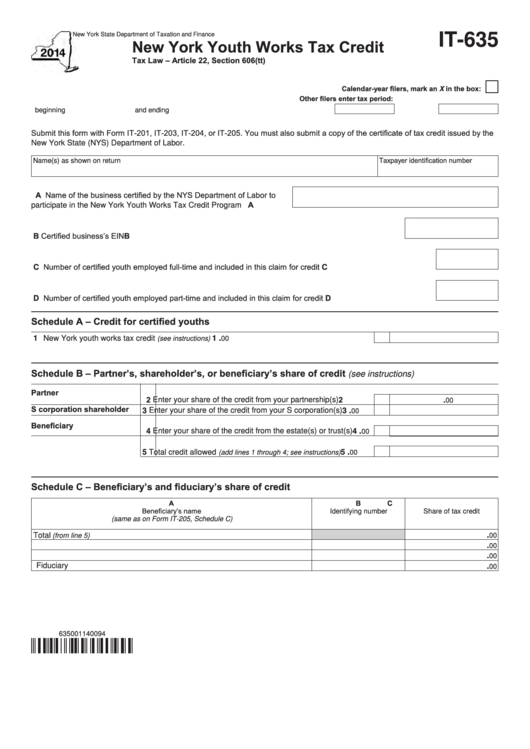

New York State Department of Taxation and Finance

IT-635

New York Youth Works Tax Credit

Tax Law – Article 22, Section 606(tt)

Calendar-year filers, mark an X in the box:

Other filers enter tax period:

beginning

and ending

Submit this form with Form IT-201, IT-203, IT-204, or IT-205. You must also submit a copy of the certificate of tax credit issued by the

New York State (NYS) Department of Labor.

Taxpayer identification number

Name(s) as shown on return

A Name of the business certified by the NYS Department of Labor to

participate in the New York Youth Works Tax Credit Program ............. A

B Certified business’s EIN ........................................................................................................................... B

C Number of certified youth employed full-time and included in this claim for credit ................................................ C

D Number of certified youth employed part-time and included in this claim for credit .............................................. D

Schedule A – Credit for certified youths

.

1 New York youth works tax credit

.........................................................................

1

(see instructions)

00

Schedule B – Partner’s, shareholder’s, or beneficiary’s share of credit

(see instructions)

Partner

2

2

Enter your share of the credit from your partnership(s) .........

.

00

S corporation shareholder

Enter your share of the credit from your S corporation(s) .......

.

3

3

00

Beneficiary

Enter your share of the credit from the estate(s) or trust(s) ....

.

4

4

00

.

5

Total credit allowed

.......

5

(add lines 1 through 4; see instructions)

00

Schedule C – Beneficiary’s and fiduciary’s share of credit

A

B

C

Beneficiary’s name

Identifying number

Share of tax credit

(same as on Form IT-205, Schedule C)

.

Total

(from line 5)

00

.

00

.

00

Fiduciary

.

00

635001140094

1

1 2

2