01-143

b.

(Rev.8-11/6)

PRINT FORM

CLEAR FORM

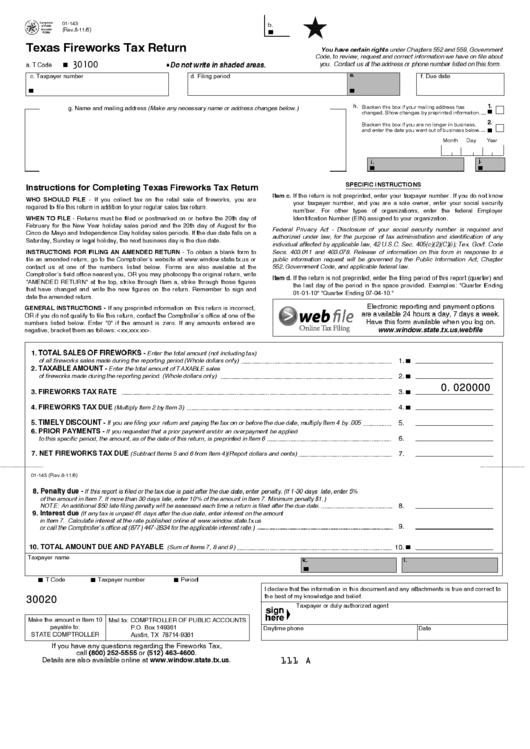

Texas Fireworks Tax Return

You have certain rights under Chapters 552 and 559, Government

Code, to review, request and correct information we have on file about

30100

you. Contact us at the address or phone number listed on this form.

a. T Code

Do not write in shaded areas.

e.

c. Taxpayer number

d. Filing period

f. Due date

1.

h.

Blacken this box if your mailing address has

g. Name and mailing address (Make any necessary name or address changes below.)

changed. Show changes by preprinted information.

2.

Blacken this box if you are no longer in business,

and enter the date you went out of business below.

Month

Day

Year

j.

i.

Instructions for Completing Texas Fireworks Tax Return

SPECIFIC INSTRUCTIONS

Item c.

If the return is not preprinted, enter your taxpayer number. If you do not know

WHO SHOULD FILE

- If you collect tax on the retail sale of fireworks, you are

your taxpayer number, and you are a sole owner, enter your social security

required to file this return in addition to your regular sales tax return.

num\ber. For other types of organizations, enter the federal Employer

WHEN TO FILE

- Returns must be filed or postmarked on or before the 20th day of

Identification Number (EIN) assigned to your organization.

February for the New Year holiday sales period and the 20th day of August for the

Federal Privacy Act - Disclosure of your social security number is required and

Cinco de Mayo and Independence Day holiday sales periods. If the due date falls on a

authorized under law, for the purpose of tax administration and identification of any

Saturday, Sunday or legal holiday, the next business day is the due date.

individual affected by applicable law, 42 U.S.C. Sec. 405(c)(2)(C)(i); Tex. Govt. Code

INSTRUCTIONS FOR FILING AN AMENDED RETURN

- To obtain a blank form to

Secs. 403.011 and 403.078. Release of information on this form in response to a

public information request will be governed by the Public Information Act, Chapter

file an amended return, go to the Comptroller's website at or

contact us at one of the numbers listed below. Forms are also available at the

552, Government Code, and applicable federal law.

Comptroller's field office nearest you, OR you may photocopy the original return, write

Item d.

If the return is not preprinted, enter the filing period of this report (quarter) and

"AMENDED RETURN" at the top, strike through Item a, strike through those figures

the last day of the period in the space provided. Examples: "Quarter Ending

that have changed and write the new figures on the return. Remember to sign and

01-01-10" "Quarter Ending 07-04-10."

date the amended return.

Electronic reporting and payment options

GENERAL INSTRUCTIONS -

If any preprinted information on this return is incorrect,

are available 24 hours a day, 7 days a week.

OR if you do not qualify to file this return, contact the Comptroller's office at one of the

Have this form available when you log on.

numbers listed below. Enter "0" if the amount is zero. If any amounts entered are

negative, bracket them as follows: <xx,xxx.xx>.

/webfile

1. TOTAL SALES OF FIREWORKS -

Enter the total amount (not including tax)

1.

of all fireworks sales made during the reporting period (Whole dollars only)

2. TAXABLE AMOUNT -

Enter the total amount of TAXABLE sales

2.

of fireworks made during the reporting period. (Whole dollars only)

0.020000

3. FIREWORKS TAX RATE

3.

4. FIREWORKS TAX DUE

4.

(Multiply Item 2 by Item 3)

5. TIMELY DISCOUNT -

5.

If you are filing your return and paying the tax on or before the due date, multiply Item 4 by .005

6. PRIOR PAYMENTS -

If you requested that a prior payment and/or an overpayment be applied

6.

to this specific period, the amount, as of the date of this return, is preprinted in Item 6

7. NET FIREWORKS TAX DUE

7.

(Subtract Items 5 and 6 from Item 4)(Report dollars and cents)

01-143 (Rev.8-11/6)

8. Penalty due -

If this report is filed or the tax due is paid after the due date, enter penalty. (If 1-30 days late, enter 5%

of the amount in Item 7. If more than 30 days late, enter 10% of the amount in Item 7. Minimum penalty $1.)

8.

NOTE: An additional $50 late filing penalty will be assessed each time a return is filed after the due date.

9. Interest due

(If any tax is unpaid 61 days after the due date, enter interest on the amount

in Item 7. Calculate interest at the rate published online at

9.

or call the Comptroller's office at (877) 447-2834 for the applicable interest rate.)

10. TOTAL AMOUNT DUE AND PAYABLE

10.

(Sum of Items 7, 8 and 9)

Taxpayer name

k.

l.

T Code

Taxpayer number

Period

I declare that the information in this document and any attachments is true and correct to

the best of my knowledge and belief.

30020

Taxpayer or duly authorized agent

Make the amount in Item 10

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

payable to:

P.O. Box 149361

Daytime phone

Date

STATE COMPTROLLER

Austin, TX 78714-9361

If you have any questions regarding the Fireworks Tax,

call (800) 252-5555 or (512) 463-4600 .

111 A

Details are also available online at .

1

1