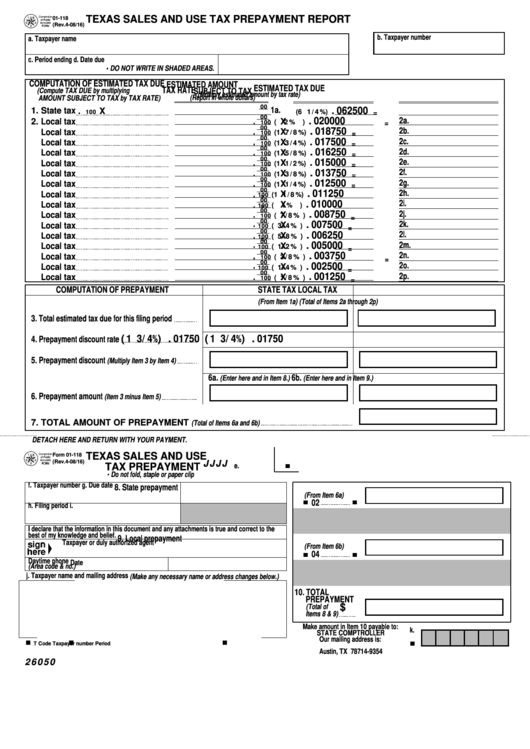

TEXAS SALES AND USE TAX PREPAYMENT REPORT

01-118

(Rev.4-08/16)

b. Taxpayer number

a. Taxpayer name

c. Period ending

d. Date due

.

DO NOT WRITE IN SHADED AREAS.

COMPUTATION OF ESTIMATED TAX DUE

ESTIMATED AMOUNT

ESTIMATED TAX DUE

TAX RATE

(Compute TAX DUE by multiplying

SUBJECT TO TAX

(Multiply estimated amount by tax rate)

(Report in whole dollars)

AMOUNT SUBJECT TO TAX by TAX RATE)

00

1a.

.

.062500

1. State tax

X

(6 1/4%)

100

=

00

2a.

.

.020000

2. Local tax

X

(

2%

)

=

100

00

2b.

.

.018750

Local tax

X

(1 7/8%)

100

=

00

2c.

.

.017500

X

Local tax

(1 3/4%)

100

=

00

2d.

.

.016250

Local tax

X

(1 5/8%)

100

=

00

2e.

.

.015000

Local tax

X

(1 1/2%)

100

=

00

2f.

.

.013750

X

Local tax

(1 3/8%)

100

=

00

2g.

.

.012500

Local tax

X

(1 1/4%)

100

=

00

2h.

.011250

.

X

Local tax

(1 1/8%)

100

=

00

2i.

.010000

Local tax

.

X

(

1%

)

100

=

00

2j.

.

.008750

Local tax

X

( 7/8% )

100

=

00

.

2k.

.007500

X

Local tax

( 3/4% )

100

=

00

2l.

.

.006250

Local tax

X

( 5/8% )

100

=

00

.

2m.

.005000

Local tax

X

( 1/2% )

100

=

00

2n.

.

.003750

.

X

Local tax

( 3/8% )

100

=

00

.

2o.

.002500

Local tax

X

( 1/4% )

100

=

00

2p.

.

.001250

X

Local tax

( 1/8% )

100

=

COMPUTATION OF PREPAYMENT

STATE TAX

LOCAL TAX

(From Item 1a)

(Total of Items 2a through 2p)

3. Total estimated tax due for this filing period

(1 3/4%)

.01750

(1 3/4%)

.01750

4. Prepayment discount rate

5. Prepayment discount

(Multiply Item 3 by Item 4)

6a.

6b.

(Enter here and in Item 8.)

(Enter here and in Item 9.)

6. Prepayment amount

(Item 3 minus Item 5)

7. TOTAL AMOUNT OF PREPAYMENT

(Total of Items 6a and 6b)

DETACH HERE AND RETURN WITH YOUR PAYMENT.

TEXAS SALES AND USE

Form 01-118

(Rev.4-08/16)

JJJJ

TAX PREPAYMENT

e.

.

Do not fold, staple or paper clip

f. Taxpayer number

g. Due date

8. State prepayment

(From Item 6a)

02

h. Filing period

i.

I declare that the information in this document and any attachments is true and correct to the

best of my knowledge and belief.

9. Local prepayment

Taxpayer or duly authorized agent

(From Item 6b)

04

Daytime phone

Date

(Area code & no.)

j. Taxpayer name and mailing address (Make any necessary name or address changes below.)

10. TOTAL

PREPAYMENT

$

(Total of

Items 8 & 9)

Make amount in Item 10 payable to:

k.

STATE COMPTROLLER

Our mailing address is:

T Code

Taxpayer number

Period

P.O. Box 149354

Austin, TX 78714-9354

26050

1

1 2

2