Form 01-118 - Instructions For Completing Texas Sales And Use Tax Prepayment Report

ADVERTISEMENT

Form 01-118 (Back)(Rev.1-97/14)

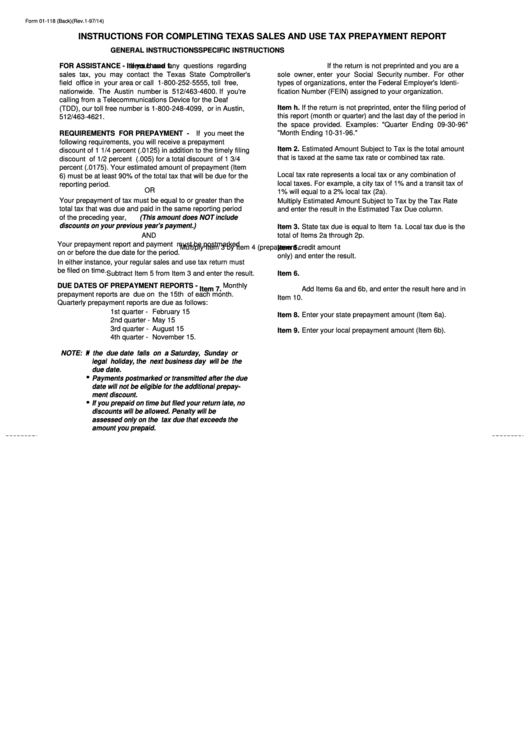

INSTRUCTIONS FOR COMPLETING TEXAS SALES AND USE TAX PREPAYMENT REPORT

GENERAL INSTRUCTIONS

SPECIFIC INSTRUCTIONS

FOR ASSISTANCE -

If you have any questions regarding

Items b and f.

If the return is not preprinted and you are a

sales tax, you may contact the Texas State Comptroller's

sole owner, enter your Social Security number. For other

field office in your area or call 1-800-252-5555, toll free,

types of organizations, enter the Federal Employer's Identi-

nationwide. The Austin number is 512/463-4600. If you're

fication Number (FEIN) assigned to your organization.

calling from a Telecommunications Device for the Deaf

Item h.

If the return is not preprinted, enter the filing period of

(TDD), our toll free number is 1-800-248-4099, or in Austin,

this report (month or quarter) and the last day of the period in

512/463-4621.

the space provided. Examples: "Quarter Ending 09-30-96"

"Month Ending 10-31-96."

REQUIREMENTS FOR PREPAYMENT -

If you meet the

following requirements, you will receive a prepayment

Item 2.

Estimated Amount Subject to Tax is the total amount

discount of 1 1/4 percent (.0125) in addition to the timely filing

that is taxed at the same tax rate or combined tax rate.

discount of 1/2 percent (.005) for a total discount of 1 3/4

percent (.0175). Your estimated amount of prepayment (Item

Local tax rate represents a local tax or any combination of

6) must be at least 90% of the total tax that will be due for the

local taxes. For example, a city tax of 1% and a transit tax of

reporting period.

OR

1% will equal to a 2% local tax (2a).

Your prepayment of tax must be equal to or greater than the

Multiply Estimated Amount Subject to Tax by the Tax Rate

total tax that was due and paid in the same reporting period

and enter the result in the Estimated Tax Due column.

(This amount does NOT include

of the preceding year,

discounts on your previous year's payment.)

Item 3.

State tax due is equal to Item 1a. Local tax due is the

AND

total of Items 2a through 2p.

Your prepayment report and payment must be postmarked

Item 5.

Multiply Item 3 by Item 4 (prepayment credit amount

on or before the due date for the period.

only) and enter the result.

In either instance, your regular sales and use tax return must

be filed on time.

Item 6.

Subtract Item 5 from Item 3 and enter the result.

DUE DATES OF PREPAYMENT REPORTS -

Monthly

Item 7.

Add Items 6a and 6b, and enter the result here and in

prepayment reports are due on the 15th of each month.

Item 10.

Quarterly prepayment reports are due as follows:

1st quarter -

February 15

Item 8.

Enter your state prepayment amount (Item 6a).

2nd quarter -

May 15

3rd quarter -

August 15

Item 9.

Enter your local prepayment amount (Item 6b).

4th quarter -

November 15.

NOTE:

If the due date falls on a Saturday, Sunday or

legal holiday, the next business day will be the

due date.

Payments postmarked or transmitted after the due

date will not be eligible for the additional prepay-

ment discount.

If you prepaid on time but filed your return late, no

discounts will be allowed. Penalty will be

assessed only on the tax due that exceeds the

amount you prepaid.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1