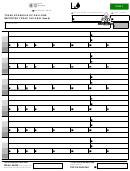

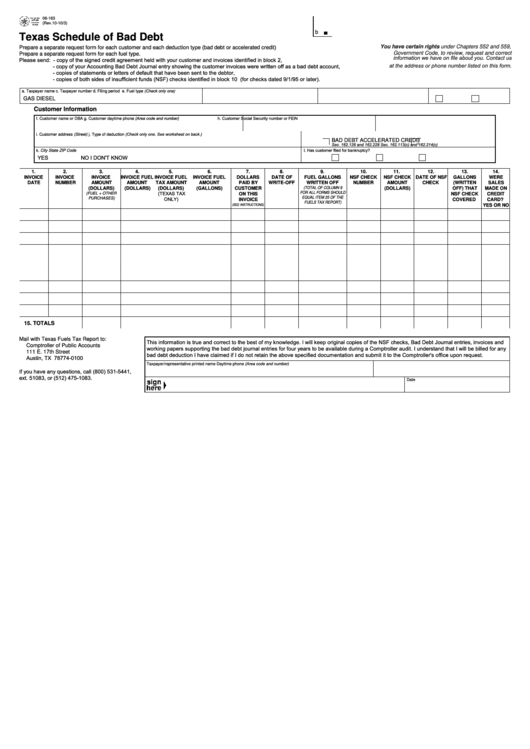

06-163

PRINT FORM

CLEAR FORM

(Rev.10-10/3)

b

Texas Schedule of Bad Debt

You have certain rights under Chapters 552 and 559,

Prepare a separate request form for each customer and each deduction type (bad debt or accelerated credit)

Government Code, to review, request and correct

Prepare a separate request form for each fuel type.

information we have on file about you. Contact us

Please send: - copy of the signed credit agreement held with your customer and invoices identified in block 2,

at the address or phone number listed on this form.

- copy of your Accounting Bad Debt Journal entry showing the customer invoices were written off as a bad debt account,

- copies of statements or letters of default that have been sent to the debtor,

- copies of both sides of insufficient funds (NSF) checks identified in block 10 (for checks dated 9/1/95 or later).

a. Taxpayer name

c. Taxpayer number

d. Filing period

e. Fuel type (Check only one)

GAS

DIESEL

Customer Information

g. Customer daytime phone (Area code and number)

h. Customer Social Security number or FEIN

f. Customer name or DBA

j. Type of deduction (Check only one. See worksheet on back.)

i. Customer address (Street)

BAD DEBT

ACCELERATED CREDIT

Sec. 162.126 and 162.228

Sec. 162.113(c) and 162.214(c)

k. City State ZIP Code

l. Has customer filed for bankruptcy?

YES

NO

I DON'T KNOW

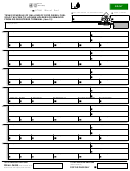

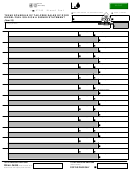

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

InvoICe

InvoICe

InvoICe

InvoICe FueL

InvoICe FueL

InvoICe FueL

DoLLarS

DaTe oF

FueL GaLLonS

nSF CheCk

nSF CheCk

DaTe oF nSF

GaLLonS

Were

DaTe

numBer

amounT

amounT

Tax amounT

amounT

paID By

WrITe-oFF

WrITTen oFF

numBer

amounT

CheCk

(WrITTen

SaLeS

(DoLLarS)

(DoLLarS)

(DoLLarS)

(GaLLonS)

CuSTomer

(TOTAL Of COLUmn 9

(DoLLarS)

oFF) ThaT

maDe on

(TEXAS TAX

fOR ALL fORmS SHOULd

(fUEL + OTHER

on ThIS

nSF CheCk

CreDIT

EqUAL ITEm 25 Of THE

PURCHASES)

ONlY)

InvoICe

CovereD

CarD?

fUELS TAx REPORT)

(SEE InSTRUCTIOnS)

yeS or no

15. ToTaLS

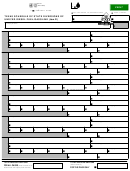

Mail with Texas Fuels Tax Report to:

This information is true and correct to the best of my knowledge. I will keep original copies of the NSF checks, Bad Debt Journal entries, invoices and

Comptroller of Public Accounts

working papers supporting the bad debt journal entries for four years to be available during a Comptroller audit. I understand that I will be billed for any

111 E. 17th Street

bad debt deduction I have claimed if I do not retain the above specified documentation and submit it to the Comptroller's office upon request.

Austin, TX 78774-0100

Daytime phone (Area code and number)

Taxpayer/representative printed name

If you have any questions, call (800) 531-5441,

ext. 51083, or (512) 475-1083.

Date

true

1

1 2

2