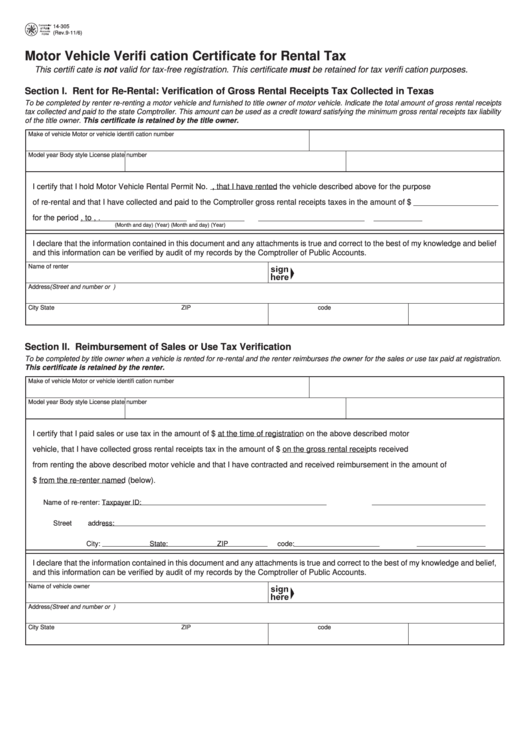

14-305

RESET FORM

PRINT FORM

(Rev.9-11/6)

Motor Vehicle Verifi cation Certificate for Rental Tax

This certifi cate is not valid for tax-free registration. This certificate must be retained for tax verifi cation purposes.

Section I. Rent for Re-Rental: Verification of Gross Rental Receipts Tax Collected in Texas

To be completed by renter re-renting a motor vehicle and furnished to title owner of motor vehicle. Indicate the total amount of gross rental receipts

tax collected and paid to the state Comptroller. This amount can be used as a credit toward satisfying the minimum gross rental receipts tax liability

of the title owner. This certificate is retained by the title owner.

Make of vehicle

Motor or vehicle identifi cation number

Model year

Body style

License plate number

I certify that I hold Motor Vehicle Rental Permit No.

, that I have rented the vehicle described above for the purpose

of re-rental and that I have collected and paid to the Comptroller gross rental receipts taxes in the amount of $

for the period

,

to

,

.

(Month and day)

(Year)

(Month and day)

(Year)

I declare that the information contained in this document and any attachments is true and correct to the best of my knowledge and belief

and this information can be verified by audit of my records by the Comptroller of Public Accounts.

Name of renter

Address (Street and number or P.O. Box number)

City

State

ZIP code

Section II. Reimbursement of Sales or Use Tax Verification

To be completed by title owner when a vehicle is rented for re-rental and the renter reimburses the owner for the sales or use tax paid at registration.

This certificate is retained by the renter.

Make of vehicle

Motor or vehicle identifi cation number

Model year

Body style

License plate number

I certify that I paid sales or use tax in the amount of $

at the time of registration on the above described motor

vehicle, that I have collected gross rental receipts tax in the amount of $

on the gross rental receipts received

from renting the above described motor vehicle and that I have contracted and received reimbursement in the amount of

$

from the re-renter named (below).

Name of re-renter:

Taxpayer ID:

Street address:

City:

State:

ZIP code:

I declare that the information contained in this document and any attachments is true and correct to the best of my knowledge and belief,

and this information can be verified by audit of my records by the Comptroller of Public Accounts.

Name of vehicle owner

Address (Street and number or P.O. Box number)

City

State

ZIP code

1

1 2

2