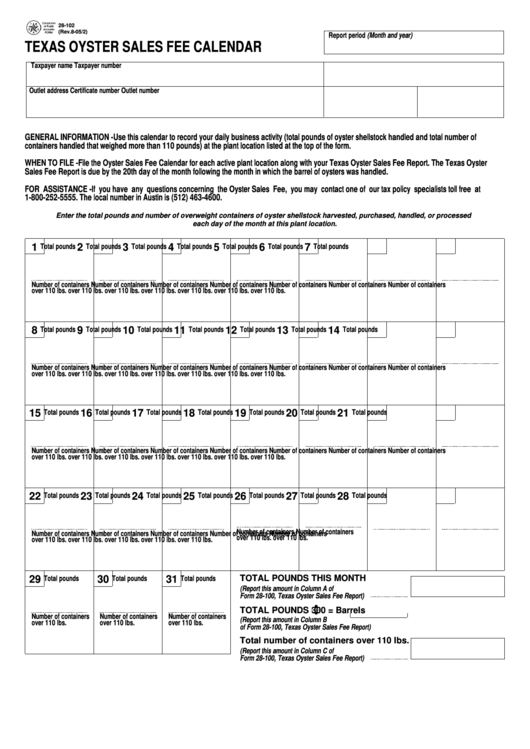

28-102

(Rev.8-05/2)

Report period (Month and year)

TEXAS OYSTER SALES FEE CALENDAR

Taxpayer name

Taxpayer number

Certificate number

Outlet number

Outlet address

GENERAL INFORMATION - Use this calendar to record your daily business activity (total pounds of oyster shellstock handled and total number of

containers handled that weighed more than 110 pounds) at the plant location listed at the top of the form.

WHEN TO FILE - File the Oyster Sales Fee Calendar for each active plant location along with your Texas Oyster Sales Fee Report. The Texas Oyster

Sales Fee Report is due by the 20th day of the month following the month in which the barrel of oysters was handled.

FOR ASSISTANCE - If you have any questions concerning the Oyster Sales Fee, you may contact one of our tax policy specialists toll free at

1-800-252-5555. The local number in Austin is (512) 463-4600.

Enter the total pounds and number of overweight containers of oyster shellstock harvested, purchased, handled, or processed

each day of the month at this plant location.

1

2

3

4

5

6

7

Total pounds

Total pounds

Total pounds

Total pounds

Total pounds

Total pounds

Total pounds

Number of containers

Number of containers

Number of containers

Number of containers

Number of containers

Number of containers

Number of containers

over 110 lbs.

over 110 lbs.

over 110 lbs.

over 110 lbs.

over 110 lbs.

over 110 lbs.

over 110 lbs.

8

9

10

11

12

13

14

Total pounds

Total pounds

Total pounds

Total pounds

Total pounds

Total pounds

Total pounds

Number of containers

Number of containers

Number of containers

Number of containers

Number of containers

Number of containers

Number of containers

over 110 lbs.

over 110 lbs.

over 110 lbs.

over 110 lbs.

over 110 lbs.

over 110 lbs.

over 110 lbs.

15

16

17

18

19

20

21

Total pounds

Total pounds

Total pounds

Total pounds

Total pounds

Total pounds

Total pounds

Number of containers

Number of containers

Number of containers

Number of containers

Number of containers

Number of containers

Number of containers

over 110 lbs.

over 110 lbs.

over 110 lbs.

over 110 lbs.

over 110 lbs.

over 110 lbs.

over 110 lbs.

22

23

24

25

26

27

28

Total pounds

Total pounds

Total pounds

Total pounds

Total pounds

Total pounds

Total pounds

Number of containers

Number of containers

Number of containers

Number of containers

Number of containers

Number of containers

Number of containers

over 110 lbs.

over 110 lbs.

over 110 lbs.

over 110 lbs.

over 110 lbs.

over 110 lbs.

over 110 lbs.

29

30

31

TOTAL POUNDS THIS MONTH

Total pounds

Total pounds

Total pounds

(Report this amount in Column A of

Form 28-100, Texas Oyster Sales Fee Report)

TOTAL POUNDS

300 =

Barrels

Number of containers

Number of containers

Number of containers

(Report this amount in Column B

over 110 lbs.

over 110 lbs.

over 110 lbs.

of Form 28-100, Texas Oyster Sales Fee Report)

Total number of containers over 110 lbs.

(Report this amount in Column C of

Form 28-100, Texas Oyster Sales Fee Report)

1

1