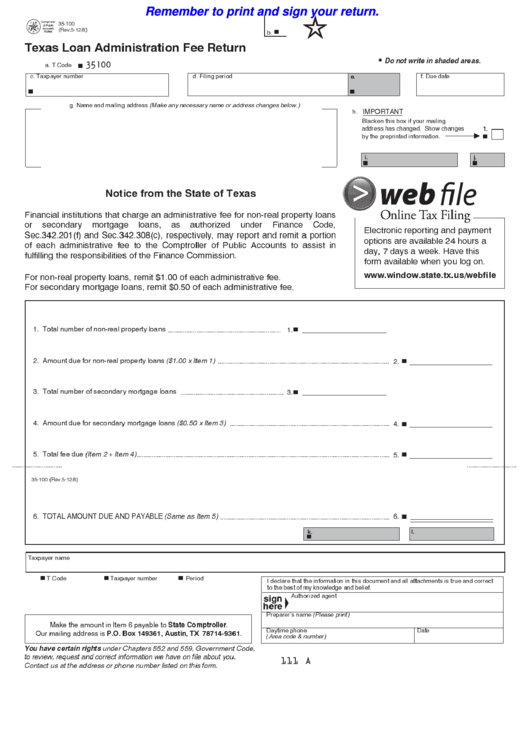

Remember to print and sign your return.

PRINT

35-100

b.

(Rev.5-12/8)

Texas Loan Administration Fee Return

35100

a. T Code

Do not write in shaded areas.

c. Taxpayer number

d. Filing period

f. Due date

e.

g. Name and mailing address (Make any necessary name or address changes below.)

IMPORTANT

h.

Blacken this box if your mailing

address has changed. Show changes

1.

by the preprinted information.

j.

i.

Notice from the State of Texas

Financial institutions that charge an administrative fee for non-real property loans

or secondary mortgage loans, as authorized under Finance Code,

Electronic reporting and payment

Sec.342.201(f) and Sec.342.308(c), respectively, may report and remit a portion

options are available 24 hours a

of each administrative fee to the Comptroller of Public Accounts to assist in

day, 7 days a week. Have this

fulfilling the responsibilities of the Finance Commission.

form available when you log on.

For non-real property loans, remit $1.00 of each administrative fee.

For secondary mortgage loans, remit $0.50 of each administrative fee.

1. Total number of non-real property loans

1.

2. Amount due for non-real property loans ($1.00 x Item 1)

2.

3. Total number of secondary mortgage loans

3.

4. Amount due for secondary mortgage loans ($0.50 x Item 3)

4.

5. Total fee due (Item 2 + Item 4)

5.

35-100 (Rev.5-12/8)

6. TOTAL AMOUNT DUE AND PAYABLE (Same as Item 5)

6.

k.

l.

Taxpayer name

T Code

Taxpayer number

Period

I declare that the information in this document and all attachments is true and correct

to the best of my knowledge and belief.

Authorized agent

Preparer's name (Please print)

State Comptroller

Make the amount in Item 6 payable to

.

Daytime phone

Date

P.O. Box 149361, Austin, TX 78714-9361

Our mailing address is

.

(Area code & number)

under Chapters 552 and 559, Government Code,

You have certain rights

to review, request and correct information we have on file about you.

111 A

Contact us at the address or phone number listed on this form.

1

1 2

2