Form Boe-268-A - Claim For Exemption From Property Taxes (Public School Exemption) - California

ADVERTISEMENT

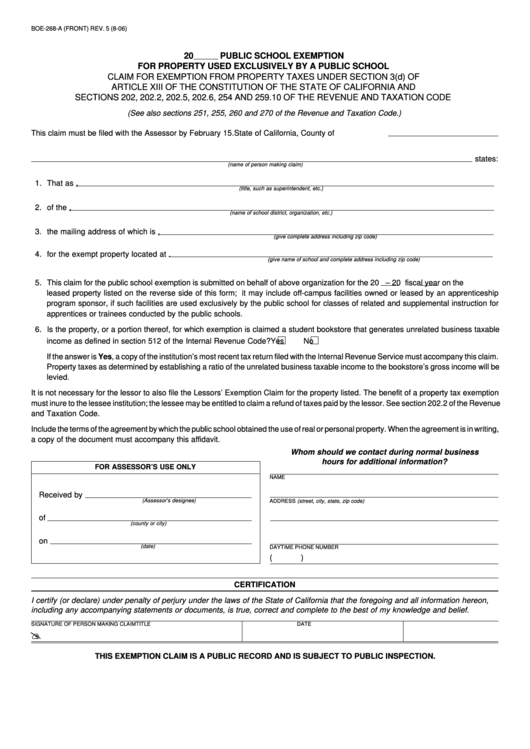

BOE-268-A (FRONT) REV. 5 (8-06)

20

PUBLIC SCHOOL EXEMPTION

FOR PROPERTY USED EXCLUSIVELY BY A PUBLIC SCHOOL

CLAIM FOR EXEMPTION FROM PROPERTY TAXES UNDER SECTION 3(d) OF

ARTICLE XIII OF THE CONSTITUTION OF THE STATE OF CALIFORNIA AND

SECTIONS 202, 202.2, 202.5, 202.6, 254 AND 259.10 OF THE REVENUE AND TAXATION CODE

(See also sections 251, 255, 260 and 270 of the Revenue and Taxation Code.)

This claim must be filed with the Assessor by February 15.

State of California, County of

states:

(name of person making claim)

1. That as

,

(title, such as superintendent, etc.)

2. of the

,

(name of school district, organization, etc.)

3. the mailing address of which is

,

(give complete address including zip code)

4. for the exempt property located at

.

(give name of school and complete address including zip code)

5. This claim for the public school exemption is submitted on behalf of above organization for the 20

– 20

fiscal year on the

leased property listed on the reverse side of this form; it may include off-campus facilities owned or leased by an apprenticeship

program sponsor, if such facilities are used exclusively by the public school for classes of related and supplemental instruction for

apprentices or trainees conducted by the public schools.

6. Is the property, or a portion thereof, for which exemption is claimed a student bookstore that generates unrelated business taxable

income as defined in section 512 of the Internal Revenue Code?

Yes

No

If the answer is Yes, a copy of the institution’s most recent tax return filed with the Internal Revenue Service must accompany this claim.

Property taxes as determined by establishing a ratio of the unrelated business taxable income to the bookstore’s gross income will be

levied.

It is not necessary for the lessor to also file the Lessors’ Exemption Claim for the property listed. The benefit of a property tax exemption

must inure to the lessee institution; the lessee may be entitled to claim a refund of taxes paid by the lessor. See section 202.2 of the Revenue

and Taxation Code.

Include the terms of the agreement by which the public school obtained the use of real or personal property. When the agreement is in writing,

a copy of the document must accompany this affidavit.

Whom should we contact during normal business

hours for additional information?

FOR ASSESSOR’S USE ONLY

NAME

Received by

(Assessor’s designee)

ADDRESS (street, city, state, zip code)

of

(county or city)

on

(date)

DAYTIME PHONE NUMBER

(

)

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon,

including any accompanying statements or documents, is true, correct and complete to the best of my knowledge and belief.

SIGNATURE OF PERSON MAKING CLAIM

TITLE

DATE

?

THIS EXEMPTION CLAIM IS A PUBLIC RECORD AND IS SUBJECT TO PUBLIC INSPECTION.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2