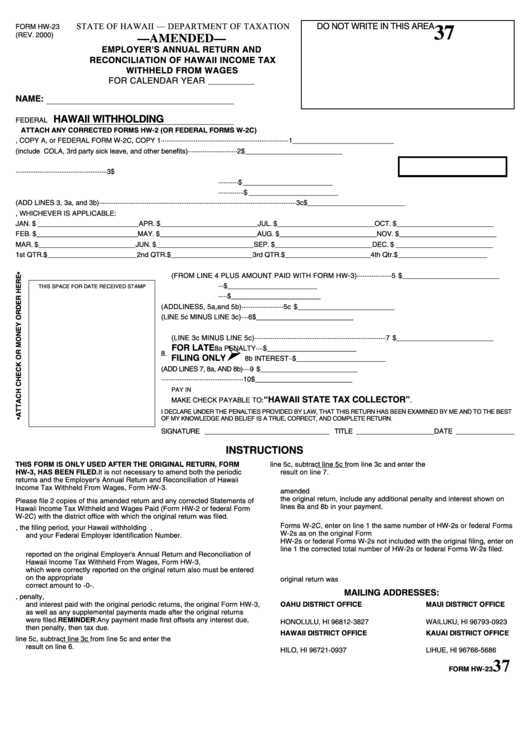

Form Hw-23 - Amended Employer'S Annual Return And Reconciliation Of Hawaii Income Tax Withheld From Wages - 2000

ADVERTISEMENT

DO NOT WRITE IN THIS AREA

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM HW-23

37

(REV. 2000)

—AMENDED—

EMPLOYER'S ANNUAL RETURN AND

RECONCILIATION OF HAWAII INCOME TAX

WITHHELD FROM WAGES

FOR CALENDAR YEAR

NAME:

HAWAII WITHHOLDING I.D. NO. __ __ __ __ __ __ __ __

FEDERAL I.D. NO.

ATTACH ANY CORRECTED FORMS HW-2 (OR FEDERAL FORMS W-2C)

1. NUMBER OF HW-2 FORMS, COPY A, or FEDERAL FORM W-2C, COPY 1······································································1 __________________________

2. TOTAL WAGES SHOWN ON THESE FORMS (include COLA, 3rd party sick leave, and other benefits) ···························2 $ _________________________

3. TOTAL HAWAII INCOME TAX WITHHELD FROM WAGES SHOWN ON THESE FORMS··················································3 $

3a. PENALTIES ··········· $ _______________________

3b. INTEREST ·············· $ _______________________

3c. TOTAL AMOUNT DUE (ADD LINES 3, 3a, and 3b) ············································································································3c $ _________________________

4. PAYMENT OF TAXES WITHHELD BY MONTHS OR CALENDAR QUARTERS, WHICHEVER IS APPLICABLE:

JAN. $ __________________________ APR. $ _________________________ JUL. $ _________________________ OCT. $ _________________________

FEB. $ __________________________ MAY. $ _________________________ AUG. $ _________________________ NOV. $ _________________________

MAR. $ _________________________ JUN. $ _________________________ SEP. $ _________________________ DEC. $ _________________________

1st QTR. $_______________________ 2nd QTR. $ _____________________ 3rd QTR. $ ______________________ 4th Qtr. $ _______________________

5. TOTAL PAYMENTS OF TAXES WITHHELD

(FROM LINE 4 PLUS AMOUNT PAID WITH FORM HW-3) ···················5 $ _________________________

5a. PENALTIES PAID ··· $ _______________________

THIS SPACE FOR DATE RECEIVED STAMP

5b. INTEREST PAID ····· $ _______________________

5c. TOTAL PAYMENTS MADE (ADD LINES 5, 5a, and 5b) ·······················5c $ _________________________

6. AMOUNT OF CREDIT TO BE REFUNDED (LINE 5c MINUS LINE 3c)····6 $ _________________________

7. AMOUNT OF TAXES NOW DUE AND PAYABLE

(LINE 3c MINUS LINE 5c)········································································7 $ _________________________

Ø

FOR LATE

8a PENALTY ···· $ _______________________

8.

FILING ONLY

8b INTEREST ·· $ _______________________

9. TOTAL AMOUNT NOW DUE AND PAYABLE (ADD LINES 7, 8a, AND 8b) ····9 $ _________________________

10. PLEASE ENTER AMOUNT OF PAYMENT ·············································10 $ _________________________

PAY IN U.S. DOLLARS ON ANY U.S. BANK

“HAWAII STATE TAX COLLECTOR”

MAKE CHECK PAYABLE TO:

.

I DECLARE UNDER THE PENALTIES PROVIDED BY LAW, THAT THIS RETURN HAS BEEN EXAMINED BY ME AND TO THE BEST

OF MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT, AND COMPLETE RETURN.

SIGNATURE ________________________________ TITLE ____________________ DATE _______________

INSTRUCTIONS

THIS FORM IS ONLY USED AFTER THE ORIGINAL RETURN, FORM

5. If line 3c is more than line 5c, subtract line 5c from line 3c and enter the

HW-3, HAS BEEN FILED. It is not necessary to amend both the periodic

result on line 7.

returns and the Employer's Annual Return and Reconciliation of Hawaii

6. Enter on line 10 the amount of any payment being made with the

Income Tax Withheld From Wages, Form HW-3.

amended return. If the amended return is being filed after the due date of

the original return, include any additional penalty and interest shown on

Please file 2 copies of this amended return and any corrected Statements of

lines 8a and 8b in your payment.

Hawaii Income Tax Withheld and Wages Paid (Form HW-2 or federal Form

W-2C) with the district office with which the original return was filed.

7. If you are filing this return just to transmit corrected Forms HW-2 or federal

Forms W-2C, enter on line 1 the same number of HW-2s or federal Forms

1. Enter your name, the filing period, your Hawaii withholding I.D. number,

W-2s as on the original Form HW-3. If you are filing this return to transmit

and your Federal Employer Identification Number.

HW-2s or federal Forms W-2s not included with the original filing, enter on

2. Enter on lines 1 through 4 the corrected amounts which should have been

line 1 the corrected total number of HW-2s or federal Forms W-2s filed.

reported on the original Employer's Annual Return and Reconciliation of

8. Prepare a duplicate copy of this amended return for your files.

Hawaii Income Tax Withheld From Wages, Form HW-3, filed. Entries

which were correctly reported on the original return also must be entered

9. Sign the amended return and file it with the district office with which the

on the appropriate line. Failure to do so will result in a change from the

original return was filed. See mailing addresses below.

correct amount to -0-.

MAILING ADDRESSES:

3. Include on lines 5 through 5c the amounts of any tax withheld, penalty,

and interest paid with the original periodic returns, the original Form HW-3,

OAHU DISTRICT OFFICE

MAUI DISTRICT OFFICE

as well as any supplemental payments made after the original returns

P.O. BOX 3827

P.O. BOX 923

were filed. REMINDER: Any payment made first offsets any interest due,

HONOLULU, HI 96812-3827

WAILUKU, HI 96793-0923

then penalty, then tax due.

HAWAII DISTRICT OFFICE

KAUAI DISTRICT OFFICE

4. If line 3c is less than line 5c, subtract line 3c from line 5c and enter the

P.O. BOX 937

P.O. BOX 1686

result on line 6.

HILO, HI 96721-0937

LIHUE, HI 96766-5686

37

FORM HW-23

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1