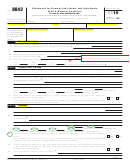

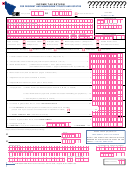

SCHEDULE NR INSTRUCTIONS

A nonresident estate/trust is subject to Maine income tax only on

of the partnership preceding the year of sale by the total sales

income derived from sources within Maine. See 36 M.R.S. § 5142

for that same year. Multiply the result by the gain or loss on the

(nonresident taxable income) and MRS Rule No. 806 (nonresident

sale of the partnership interest reported on the federal return.

individual income tax). This includes the following:

“Sales” for purposes of computing the sales factor are defi ned

in Rule No. 801.06; and

1. Salaries and wages earned working in Maine, including

all taxable benefi ts such as annual and sick leave except

6. Maine State Lottery or Tri-State Lottery winnings from tickets

for certain salaries and wages earned by the spouse of a

purchased within Maine on or after July 13, 1993, including

nonresident military servicemember;

payments received from third parties for the transfer of rights

to future proceeds related to Maine State Lottery or Tri-state

2. Distributive share of income (loss) from partnerships and S

Lotto tickets purchased in Maine plus all other income from

Corporations operating in Maine;

gambling activity conducted in Maine on or after June 29, 2005.

3. Shares of estate and trust income derived from Maine sources;

Except for #5 above, income from intangible sources, such as

interest, dividends, pensions, annuities, gains or losses attributable

4. Income (loss) attributed to the ownership or disposition of real

to intangible personal property, is not Maine-source income unless it

or tangible personal property in Maine;

is attributable to a business, trade, profession or occupation carried

on in Maine.

5. Maine-source gain (or loss) from sale of a partnership interest.

NOTE: To determine the gain or loss from the sale of a

NOTE: Resident estates or trusts with nonresident or “Safe Harbor”

partnership interest attributable to Maine, divide the original

resident benefi ciaries must complete a pro forma Schedule NR (as

cost of all tangible property of the partnership located in Maine

if the estate or trust were a nonresident estate or trust) in order to

by tangible property everywhere. Tangible property includes

complete Column 6 of Schedule 2. Enter on Schedule 2, line g,

real estate, inventory and equipment. If you don’t know

Column 6 the amount from Schedule NR, line 4, Column B. Attach

these amounts, contact the partnership. If more than 50%

a copy of the pro forma Schedule NR to the Maine income tax return

of the partnership’s assets consist of intangibles, the gain (or

for the estate or trust.

loss) is allocated to Maine based on the sales factor of the

partnership. Divide the sales in Maine for the last full tax year

1

1 2

2