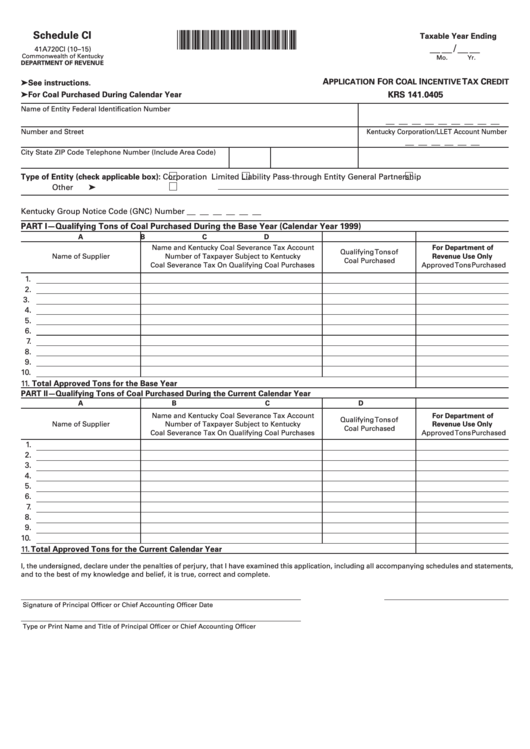

Schedule CI

*1500030221*

Taxable Year Ending

__ __ / __ __

41A720CI (10–15)

Commonwealth of Kentucky

Mo.

Yr.

DEPARTMENT OF REVENUE

A

F

C

I

T

C

PPLICATION

OR

OAL

NCENTIVE

AX

REDIT

➤ See instructions.

KRS 141.0405

➤ For Coal Purchased During Calendar Year

Name of Entity

Federal Identification Number

__ __ __ __ __ __ __ __ __

Number and Street

Kentucky Corporation/LLET Account Number

__ __ __ __ __ __

City

State

ZIP Code

Telephone Number (Include Area Code)

Corporation

Limited Liability Pass-through Entity

General Partnership

Type of Entity (check applicable box):

Other ➤

__ __ __ __ __ __

Kentucky Group Notice Code (GNC) Number

PART I—Qualifying Tons of Coal Purchased During the Base Year (Calendar Year 1999)

A

B

C

D

Name and Kentucky Coal Severance Tax Account

For Department of

Qualifying Tons of

Number of Taxpayer Subject to Kentucky

Revenue Use Only

Name of Supplier

Coal Purchased

Coal Severance Tax On Qualifying Coal Purchases

Approved Tons Purchased

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11. Total Approved Tons for the Base Year .............................................................................................................

PART II—Qualifying Tons of Coal Purchased During the Current Calendar Year

A

B

C

D

Name and Kentucky Coal Severance Tax Account

For Department of

Qualifying Tons of

Name of Supplier

Number of Taxpayer Subject to Kentucky

Revenue Use Only

Coal Purchased

Coal Severance Tax On Qualifying Coal Purchases

Approved Tons Purchased

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11. Total Approved Tons for the Current Calendar Year ..........................................................................................

I, the undersigned, declare under the penalties of perjury, that I have examined this application, including all accompanying schedules and statements,

and to the best of my knowledge and belief, it is true, correct and complete.

Signature of Principal Officer or Chief Accounting Officer

Date

Type or Print Name and Title of Principal Officer or Chief Accounting Officer

1

1 2

2