-

-

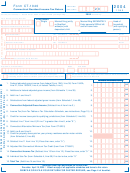

Your Social Security Number

2014 Form CT-1040 - Page 2 of 4

00

.

17. Enter amount from Line 16.

17.

,

,

3

Column A - Employer’s federal ID No. from Box b

Column B - Connecticut

Column C - Connecticut income tax

of W-2, or payer’s federal ID No. from Form 1099

wages, tips, etc.

withheld

–

.

.

00

00

18a.

18a.

W-2 and 1099

,

,

Information

–

.

.

00

00

18b.

18b.

,

,

Only enter

information

–

.

.

00

00

18c.

18c.

,

,

from your

W-2 and

–

.

.

18d.

00

18d.

00

,

,

1099 forms if

Connecticut

–

.

.

18e.

00

18e.

00

,

,

income tax

was withheld.

.

18f. Additional CT withholding from Supplemental Schedule CT-1040WH

18f.

00

,

,

18. Total Connecticut income tax withheld: Add amounts in Column C and enter here.

.

00

,

,

You must complete Columns A, B, and C or your withholding will be disallowed. 18.

.

19. All 2014 estimated tax payments and any overpayments applied from a prior year 19.

00

,

,

.

00

20. Payments made with Form CT-1040 EXT (Request for extension of time to fi le)

20.

,

,

.

20a. Connecticut earned income tax credit: From Schedule CT-EITC, Line 16.

20a.

00

,

,

20b. Claim of right credit: From Form CT-1040CRC, Line 6. Attach Form

.

CT-1040CRC to the back of this return.

20b.

00

.

21. Total payments: Add Lines 18, 19, 20, 20a, and 20b.

21.

00

,

,

4

.

00

22. Overpayment: If Line 21 is more than Line 17, subtract Line 17 from Line 21.

22.

,

,

.

23. Amount of Line 22 overpayment you want applied to your 2015 estimated tax

23.

00

,

,

24. CHET contribution from Schedule CT-CHET, Line 4. Attach Schedule CT-CHET

.

to the back of this return.

24.

00

,

,

.

24a. Total contributions of refund to designated charities from Schedule 5, Line 70

24a.

00

25. Refund: Subtract Lines 23, 24, and 24a from Line 22. For direct deposit,

.

00

complete Lines 25a, 25b, and 25c. Direct deposit is not available to fi rst-time fi lers.

25.

,

,

25a. Checking

25b. Routing

25c. Account

Savings

number

number

25d. Will this refund go to a bank account outside the U.S.?

Yes

25e. Refund as a debit card?

Yes -- If you do not elect direct deposit or debit card, a refund check will be issued and processing may be delayed.

.

5

00

26. Tax due: If Line 17 is more than Line 21, subtract Line 21 from Line 17.

26.

,

,

.

00

27. If late: Enter penalty. Multiply Line 26 by 10% (.10).

27.

,

,

28. If late: Enter interest. Multiply Line 26 by number of months or fraction of a month

.

,

,

00

late, then by 1% (.01).

28.

.

00

29. Interest on underpayment of estimated tax from Form CT-2210:

29.

,

,

See instructions, Page 21.

.

30.

30. Total amount due: Add Lines 26 through 29.

,

,

00

6

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and

statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully

delivering a false return or document to DRS is a fi ne of not more than $5,000, or imprisonment for not more than fi ve years, or both.

The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Your signature

Date

Home/cell telephone number

Your email address

Spouse’s signature (if joint return)

Date

Daytime telephone number

(

)

Paid preparer’s signature

Date

Telephone number

Preparer’s SSN or PTIN

(

)

Firm’s name, address, and ZIP code

FEIN

Third Party Designee - Complete the following to authorize DRS to contact another person about this return.

(PIN)

Designee’s name

Telephone number

Personal identifi cation number

Thank You

Complete applicable schedules on Pages 3 and 4

and send all four pages of the return to DRS.

1

1 2

2 3

3 4

4