Form Ct-1041 Schedule I - Connecticut Alternative Minimum Tax Computation Of Trusts Or Estates - 2014 Page 4

ADVERTISEMENT

of Columbia. A qualifying jurisdiction does not include the State

Line 54 - Qualifying Jurisdiction(s)

of Connecticut, the United States, or a foreign country or its

Enter the name and two-letter code of each qualifying jurisdiction

provinces (for example, Canada and Canadian Provinces).

to which you paid alternative minimum tax for which you are

No credit is allowed for any of the following:

claiming credit.

•

Alternative minimum tax paid to a jurisdiction that is not a

Standard Two-letter Codes

qualifying jurisdiction;

Alabama ................ AL

Kentucky............KY

North Carolina .....NC

•

Alternative minimum tax paid to a qualifying jurisdiction if you

Arizona .................. AZ

Louisiana ...........LA

North Dakota .......ND

claimed credit for alternative minimum tax paid to Connecticut

Arkansas ................ AR

Maine .................ME

Ohio .....................OH

on that qualifying jurisdiction’s alternative minimum tax return

California .............. CA

Maryland............MD

Oklahoma ............OK

or income tax return; or

Colorado ................ CO

Massachusetts .....MA

Oregon .................OR

•

Payments of alternative minimum tax made to a qualifying

Delaware ............... DE

Michigan ............MI

Pennsylvania........PA

jurisdiction on income not subject to the Connecticut alternative

District of Columbia DC

Minnesota ..........MN

Rhode Island ........RI

minimum tax.

Georgia .................. GA

Mississippi .........MS

South Carolina .....SC

Hawaii ................... HI

Missouri .............MO

Tennessee ............TN

The allowed credit must be computed separately for each

Idaho ..................... ID

Montana .............MT

Utah .....................UT

qualifying jurisdiction. Use separate columns for each qualifying

Illinois ................... IL

Nebraska ............NE

Vermont ...............VT

jurisdiction for which you are claiming a credit. You must attach

Indiana ................... IN

New Jersey.........NJ

Virginia ................VA

a copy of all alternative minimum tax returns fi led with qualifying

Iowa ....................... IA

New Mexico ......NM

West Virginia .......WV

jurisdictions directly following Form CT-1041 Schedule I.

Kansas ................... KS

New York ...........NY

Wisconsin ............WI

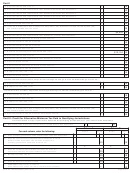

Form CT-1041 Schedule I, Part III, provides two columns, A and

Line 55 - Non-Connecticut Adjusted Federal Alternative

B, to compute the credit for two qualifying jurisdictions. If you

Minimum Taxable Income

need more than two columns, create a worksheet identical to

Part III and attach it to the back of the Form CT-1041 Schedule I.

Enter the amount of the non-Connecticut adjusted federal

alternative minimum taxable income included on Line 53 subject

If you are claiming credit for alternative minimum tax paid to

to a qualifying jurisdiction’s alternative minimum tax.

a qualifying jurisdiction and to one of its political subdivisions,

follow these rules to determine the credit:

Line 56

A. If the same amount of adjusted alternative minimum taxable

Divide the amount on Line 55 by the amount on Line 53. The

income is taxed by both the city and the state:

result may not exceed 1.0000. Round to four decimal places.

1. Use only one column of Form CT-1041 Schedule I, Part III,

to calculate your credit;

Line 57 - Net Connecticut Minimum Tax

2. Enter the same amount of adjusted alternative minimum

Resident Trusts and Estates: Enter the amount from Form

taxable income taxed by both the city and the state in

CT-1041 Schedule I, Line 21.

that column on Form CT-1041 Schedule I, Part III; and

Part-Year Resident Trusts: Enter the portion of the 2014 net

3. Combine the amounts of alternative minimum tax paid

Connecticut minimum tax liability attributable to the residency

to the city and the state and enter the total on Line 53 of

portion of the taxable year.

that column.

Line 59 - Alternative Minimum Tax Paid to Qualifying

B. If the amounts of adjusted alternative minimum taxable

Jurisdiction

income taxed by both the city and the state are not the same:

1. Use two columns on Form CT-1041 Schedule I, Part III;

Resident Trusts and Estates: Enter the total amount of

alternative minimum tax paid to a qualifying jurisdiction.

2. Include only the same amount of adjusted alternative

minimum taxable income taxed by both jurisdictions in

Part-Year Resident Trusts: Enter the amount of alternative

the fi rst column; and

minimum tax paid to a qualifying jurisdiction on items of income,

3. Include the excess amount of adjusted alternative

gain, loss, or deduction derived from or connected with sources

minimum taxable income taxed by only one of the

in that jurisdiction during the residency portion of the taxable year.

jurisdictions in the next column.

If the alternative minimum tax paid to that jurisdiction was also

based on income earned during the nonresidency portion of the

Line 53 - Modifi ed Adjusted Federal Alternative Minimum

taxable year, you must prorate the amount of tax for which you

Taxable Income

are claiming credit. The proration is based upon the relationship

Resident Trusts and Estates: Enter the amount of adjusted

that the income earned in that jurisdiction during the period of

federal alternative minimum taxable income from Form CT-1041

Connecticut residency bears to the total amount of income that

I , Part I, Line 5e. However, if this amount includes a

Schedule

the trust earned in that jurisdiction in the taxable year.

net loss derived from or connected with sources in more than

Alternative minimum tax paid means the lesser of the tax

one qualifying jurisdiction, the taxpayer must add the net loss

liability to that jurisdiction or the tax paid to that jurisdiction,

to the amount of adjusted federal alternative minimum taxable

excluding penalties and interest.

income from Line 5e and enter the result.

Line 61 - Total Credit

Part-Year Resident Trusts: Enter the amount of adjusted

federal alternative minimum taxable income from Form CT-1041

Add the amounts from Line 60, Column A; Line 60, Column B;

Schedule I, Part I, Line 5e, attributable to the residency portion

and Line 60 of any additional worksheets. The amount on Line 61

of the taxable year. However, if a part-year resident trust’s

cannot exceed Line 58. Enter the total on Line 61 and Line 22.

adjusted federal alternative minimum taxable income includes

a net loss derived from or connected with sources in more than

Attach a copy of the alternative minimum tax

one qualifying jurisdiction, the taxpayer must add the net loss

return fi led with each qualifying jurisdiction to

to the amount of adjusted federal alternative minimum taxable

income from Line 5e attributable to the residency portion of the

the back of Form CT-1041 Schedule I.

taxable year and enter the result.

Form CT-1041 Schedule I (Rev.

)

Page 4 of 4

01/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4