Resp Withdrawal Form

Download a blank fillable Resp Withdrawal Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Resp Withdrawal Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

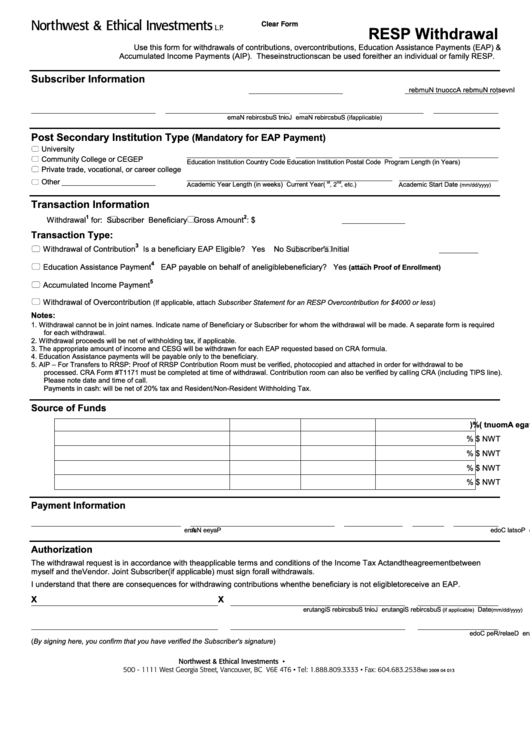

Clear Form

RESP Withdrawal

Use this form for withdrawals of contributions, overcontributions, Education Assistance Payments (EAP) &

Accumulated Income Payments (AIP). These instructions can be used for either an individual or family RESP.

Subscriber Information

n I

v

e

t s

r o

N

u

m

b

r e

A

c c

o

u

t n

N

u

m

b

r e

S

u

b

s

r c

b i

r e

N

a

m

e

J

i o

t n

S

u

b

s

r c

b i

r e

N

a

m

e

B

e

n

e

c i f

a i

y r

N

a

m

e

B

e

n

e

c i f

a i

y r

S

N I

(if applicable)

Post Secondary Institution Type

(Mandatory for EAP Payment)

University

Community College or CEGEP

Education Institution Country Code

Education Institution Postal Code

Program Length (in Years)

Private trade, vocational, or career college

Other

st

nd

Academic Year Length (in weeks)

Current Year

Academic Start Date

(e.g. 1

, 2

, etc.)

(mm/dd/yyyy)

Transaction Information

1

2

Withdrawal

for:

Subscriber

Beneficiary

Gross Amount

: $

Transaction Type:

3

Withdrawal of Contribution

Is a beneficiary EAP Eligible?

Yes

No

Subscriber's Initial

4

Education Assistance Payment

EAP payable on behalf of an eligible beneficiary?

Yes

(attach Proof of Enrollment)

5

Accumulated Income Payment

Withdrawal of Overcontribution

(If applicable, attach Subscriber Statement for an RESP Overcontribution for $4000 or less)

Notes:

1. Withdrawal cannot be in joint names. Indicate name of Beneficiary or Subscriber for whom the withdrawal will be made. A separate form is required

for each withdrawal.

2. Withdrawal proceeds will be net of withholding tax, if applicable.

3. The appropriate amount of income and CESG will be withdrawn for each EAP requested based on CRA formula.

4. Education Assistance payments will be payable only to the beneficiary.

5. AIP – For Transfers to RRSP: Proof of RRSP Contribution Room must be verified, photocopied and attached in order for withdrawal to be

processed. CRA Form #T1171 must be completed at time of withdrawal. Contribution room can also be verified by calling CRA (including TIPS line).

Please note date and time of call.

Payments in cash: will be net of 20% tax and Resident/Non-Resident Withholding Tax.

Source of Funds

F

u

n

d

N

a

m

e

F

u

n

d

C

o

d

e

D

o

l l

r a

A

m

o

u

n

( t

) $

P

e

c r

e

n

a t

g

e

A

m

o

u

n

( t

%

)

NWT

$

%

NWT

$

%

NWT

$

%

NWT

$

%

Payment Information

P

a

e y

e

N

a

m

e

A

d

d

e r

s s

C

y t i

P

o r

v

n i

c

e

P

o

t s

l a

C

o

d

e

Authorization

The withdrawal request is in accordance with the applicable terms and conditions of the Income Tax Act and the agreement between

myself and the Vendor. Joint Subscriber (if applicable) must sign for all withdrawals.

I understand that there are consequences for withdrawing contributions when the beneficiary is not eligible to receive an EAP.

X

X

S

u

b

s

r c

b i

r e

S

g i

n

a

u t

e r

J

i o

t n

S

u

b

s

r c

b i

r e

S

g i

n

a

u t

e r

Date

(if applicable)

(mm/dd/yyyy)

R

e

p

e r

s

e

n

a t

i t

e v

N

a

m

e

R

e

p

e r

s

e

n

a t

i t

e v

S

g i

n

a

u t

e r

D

e

l a

r e

R /

e

p

C

o

d

e

(By signing here, you confirm that you have verified the Subscriber's signature)

Northwest & Ethical Investments L.P. •

500 - 1111 West Georgia Street, Vancouver, BC V6E 4T6 • Tel: 1.888.809.3333 • Fax: 604.683.2538

NEI 2009 04 013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1