Form Ann43042f - Withdrawal Form For New York Life Fixed Annuities

ADVERTISEMENT

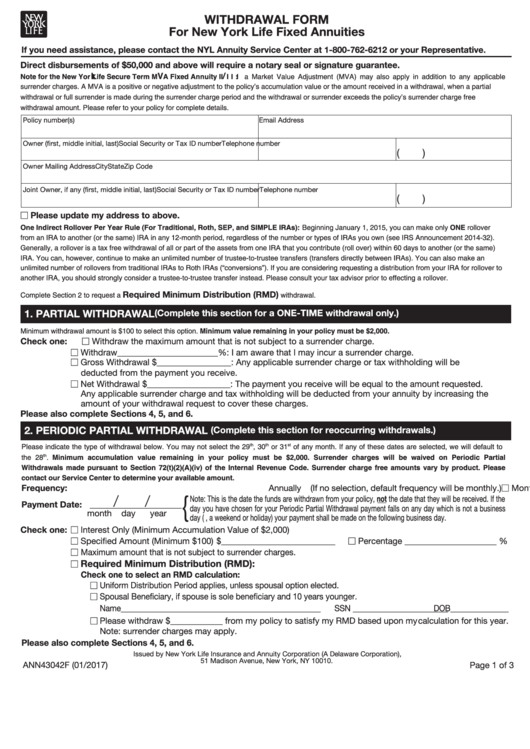

WITHDRAWAL FORM

For New York Life Fixed Annuities

If you need assistance, please contact the NYL Annuity Service Center at 1-800-762-6212 or your Representative.

Direct disbursements of $50,000 and above will require a notary seal or signature guarantee.

Note for the New Yor Life Secure Term M A Fixed Annuity II I I: a Market Value Adjustment (MVA) may also apply in addition to any applicable

I

surrender charges. A MVA is a positive or negative adjustment to the policy’s accumulation value or the amount received in a withdrawal, when a partial

withdrawal or full surrender is made during the surrender charge period and the withdrawal or surrender exceeds the policy’s surrender charge free

withdrawal amount. Please refer to your policy for complete details.

Policy number(s)

Owner (first, middle initial, last)

Social Security or Tax ID number

Telephone number

(

)

Owner Mailing Address

City

State

Zip Code

Joint Owner, if any (first, middle initial, last)

Social Security or Tax ID number

Telephone number

(

)

Please update my address to above.

One Indirect Rollover Per Year Rule (For Traditional, Roth, SEP, and SIMPLE IRAs): Beginning January 1, 2015, you can make only ONE rollover

from an IRA to another (or the same) IRA in any 12-month period, regardless of the number or types of IRAs you own (see IRS Announcement 2014-32).

Generally, a rollover is a tax free withdrawal of all or part of the assets from one IRA that you contribute (roll over) within 60 days to another (or the same)

IRA. You can, however, continue to make an unlimited number of trustee-to-trustee transfers (transfers directly between IRAs). You can also make an

unlimited number of rollovers from traditional IRAs to Roth IRAs (“conversions”). If you are considering requesting a distribution from your IRA for rollover to

another IRA, you should strongly consider a trustee-to-trustee transfer instead. Please consult your tax advisor prior to effecting a rollover.

Complete Section 2 to request a Required Minimum Distribution (RMD) withdrawal.

1. PARTIAL WITHDRAWAL

(Complete this section for a ONE-TIME withdrawal only.)

Minimum withdrawal amount is $100 to select this option. Minimum value remaining in your policy must be $2,000.

Check one:

Withdraw the maximum amount that is not subject to a surrender charge.

Withdraw _______________________%: I am aware that I may incur a surrender charge.

Gross Withdrawal $_________________: Any applicable surrender charge or tax withholding will be

deducted from the payment you receive.

Net Withdrawal $ ___________________: The payment you receive will be equal to the amount requested.

Any applicable surrender charge and tax withholding will be deducted from your annuity by increasing the

amount of your withdrawal request to cover these charges.

Please also complete Sections 4, 5, and 6.

2. PERIODIC PARTIAL WITHDRAWAL

(Complete this section for re

withdrawals.)

th

th

st

Please indicate the type of withdrawal below. You may not select the 29

, 30

or 31

of any month. If any of these dates are selected, we will default to

th

the 28

. Minimum accumulation value remaining in your policy must be $2,000. Surrender charges will be waived on Periodic Partial

Withdrawals made pursuant to Section 72(t)(2)(A)(iv) of the Internal Revenue Code. Surrender charge free amounts vary by product. Please

contact our Service Center to determine your available amount.

Frequency:

Monthly

Quarterly

Semi-Annually

Annually

(If no selection, default frequency will be monthly.)

/

/

{

Note: This is the date the funds are withdrawn from your policy, not the date that they will be received. If the

Payment Date: _____________________

day you have chosen for your Periodic Partial Withdrawal payment falls on any day which is not a business

month

day

year

day (e.g., a weekend or holiday) your payment shall be made on the following business day.

Check one:

Interest Only (Minimum Accumulation Value of $2,000)

Specified Amount (Minimum $100) $ ___________________________

Percentage _____________________ %

Maximum amount that is not subject to surrender charges.

Required Minimum Distribution (RMD):

Check one to select an RMD calculation:

Uniform Distribution Period applies, unless spousal option elected.

Spousal Beneficiary, if spouse is sole beneficiary and 10 years younger.

Name__________________________________________________ SSN ________________________ DOB_______________

Please also complete Sections 4, 5, and 6.

Issued by New York Life Insurance and Annuity Corporation (A Delaware Corporation),

51 Madison Avenue, New York, NY 10010.

ANN43042F (01/2017)

Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3