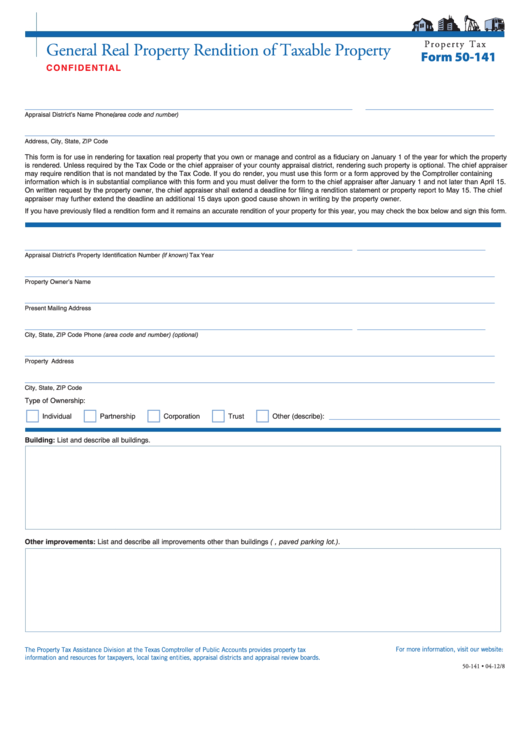

P r o p e r t y T a x

General Real Property Rendition of Taxable Property

Form 50-141

C O N F I D E N T I A L

_____________________________________________________________________

___________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Address, City, State, ZIP Code

This form is for use in rendering for taxation real property that you own or manage and control as a fiduciary on January 1 of the year for which the property

is rendered. Unless required by the Tax Code or the chief appraiser of your county appraisal district, rendering such property is optional. The chief appraiser

may require rendition that is not mandated by the Tax Code. If you do render, you must use this form or a form approved by the Comptroller containing

information which is in substantial compliance with this form and you must deliver the form to the chief appraiser after January 1 and not later than April 15.

On written request by the property owner, the chief appraiser shall extend a deadline for filing a rendition statement or property report to May 15. The chief

appraiser may further extend the deadline an additional 15 days upon good cause shown in writing by the property owner.

If you have previously filed a rendition form and it remains an accurate rendition of your property for this year, you may check the box below and sign this form.

_____________________________________________________________________

___________________________

Appraisal District’s Property Identification Number (if known)

Tax Year

___________________________________________________________________________________________________

Property Owner’s Name

___________________________________________________________________________________________________

Present Mailing Address

_____________________________________________________________________

___________________________

City, State, ZIP Code

Phone (area code and number) (optional)

___________________________________________________________________________________________________

Property Address

___________________________________________________________________________________________________

City, State, ZIP Code

Type of Ownership:

____________________________________

Individual

Partnership

Corporation

Trust

Other (describe):

Building: List and describe all buildings.

Other improvements: List and describe all improvements other than buildings (e.g. swimming pool, paved parking lot.).

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-141 • 04-12/8

1

1 2

2