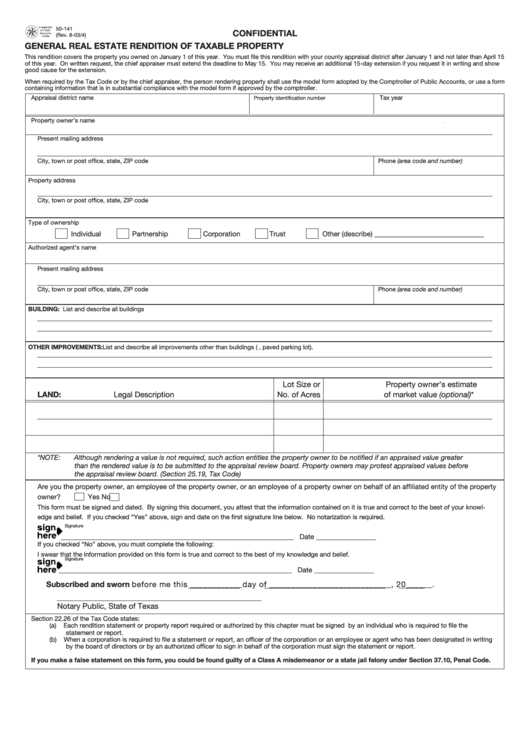

50-141

CONFIDENTIAL

(Rev. 8-03/4)

GENERAL REAL ESTATE RENDITION OF TAXABLE PROPERTY

This rendition covers the property you owned on January 1 of this year. You must file this rendition with your county appraisal district after January 1 and not later than April 15

of this year. On written request, the chief appraiser must extend the deadline to May 15. You may receive an additional 15-day extension if you request it in writing and show

good cause for the extension.

When required by the Tax Code or by the chief appraiser, the person rendering property shall use the model form adopted by the Comptroller of Public Accounts, or use a form

containing information that is in substantial compliance with the model form if approved by the comptroller.

Appraisal district name

Tax year

Property identification number

Property owner’s name

Present mailing address

City, town or post office, state, ZIP code

Phone (area code and number)

Property address

City, town or post office, state, ZIP code

Type of ownership

Individual

Partnership

Corporation

Trust

Other (describe) _______________________________

Authorized agent’s name

Present mailing address

City, town or post office, state, ZIP code

Phone (area code and number)

BUILDING: List and describe all buildings

OTHER IMPROVEMENTS: List and describe all improvements other than buildings (e.g. swimming pool, paved parking lot).

Lot Size or

Property owner’s estimate

LAND:

Legal Description

No. of Acres

of market value (optional)*

*NOTE:

Although rendering a value is not required, such action entitles the property owner to be notified if an appraised value greater

than the rendered value is to be submitted to the appraisal review board. Property owners may protest appraised values before

the appraisal review board. (Section 25.19, Tax Code)

Are you the property owner, an employee of the property owner, or an employee of a property owner on behalf of an affiliated entity of the property

owner?

Yes

No

This form must be signed and dated. By signing this document, you attest that the information contained on it is true and correct to the best of your knowl-

edge and belief. If you checked “Yes” above, sign and date on the first signature line below. No notarization is required.

Signature

__________________________________________________________________ Date _________________

If you checked “No” above, you must complete the following:

I swear that the information provided on this form is true and correct to the best of my knowledge and belief.

Signature

__________________________________________________________________ Date _________________

Subscribed and sworn before me this ____________day of ____________________________, 20______.

__________________________________________________________

Notary Public, State of Texas

Section 22.26 of the Tax Code states:

(a)

Each rendition statement or property report required or authorized by this chapter must be signed by an individual who is required to file the

statement or report.

(b)

When a corporation is required to file a statement or report, an officer of the corporation or an employee or agent who has been designated in writing

by the board of directors or by an authorized officer to sign in behalf of the corporation must sign the statement or report.

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Section 37.10, Penal Code.

1

1