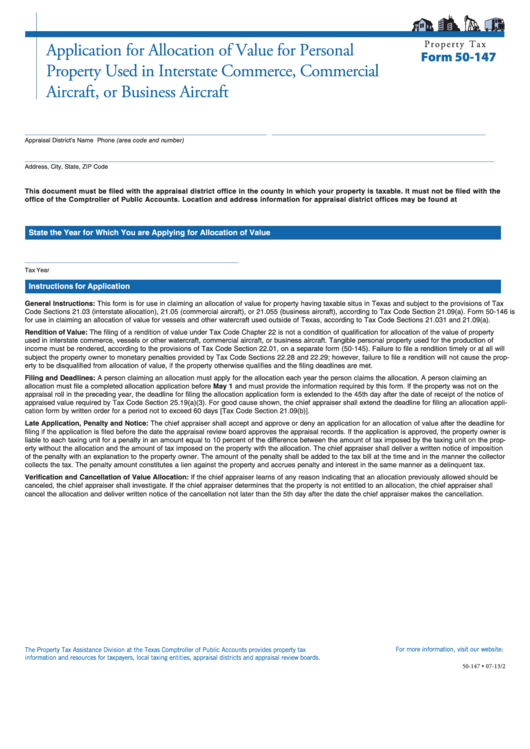

P r o p e r t y T a x

Application for Allocation of Value for Personal

Form 50-147

Property Used in Interstate Commerce, Commercial

Aircraft, or Business Aircraft

___________________________________________________

_____________________________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Address, City, State, ZIP Code

This document must be filed with the appraisal district office in the county in which your property is taxable. It must not be filed with the

office of the Comptroller of Public Accounts. Location and address information for appraisal district offices may be found at

State the Year for Which You are Applying for Allocation of Value

_____________________________________________

Tax Year

Instructions for Application

General Instructions: This form is for use in claiming an allocation of value for property having taxable situs in Texas and subject to the provisions of Tax

Code Sections 21.03 (interstate allocation), 21.05 (commercial aircraft), or 21.055 (business aircraft), according to Tax Code Section 21.09(a). Form 50-146 is

for use in claiming an allocation of value for vessels and other watercraft used outside of Texas, according to Tax Code Sections 21.031 and 21.09(a).

Rendition of Value: The filing of a rendition of value under Tax Code Chapter 22 is not a condition of qualification for allocation of the value of property

used in interstate commerce, vessels or other watercraft, commercial aircraft, or business aircraft. Tangible personal property used for the production of

income must be rendered, according to the provisions of Tax Code Section 22.01, on a separate form (50-145). Failure to file a rendition timely or at all will

subject the property owner to monetary penalties provided by Tax Code Sections 22.28 and 22.29; however, failure to file a rendition will not cause the prop-

erty to be disqualified from allocation of value, if the property otherwise qualifies and the filing deadlines are met.

Filing and Deadlines: A person claiming an allocation must apply for the allocation each year the person claims the allocation. A person claiming an

allocation must file a completed allocation application before May 1 and must provide the information required by this form. If the property was not on the

appraisal roll in the preceding year, the deadline for filing the allocation application form is extended to the 45th day after the date of receipt of the notice of

appraised value required by Tax Code Section 25.19(a)(3). For good cause shown, the chief appraiser shall extend the deadline for filing an allocation appli-

cation form by written order for a period not to exceed 60 days [Tax Code Section 21.09(b)].

Late Application, Penalty and Notice: The chief appraiser shall accept and approve or deny an application for an allocation of value after the deadline for

filing if the application is filed before the date the appraisal review board approves the appraisal records. If the application is approved, the property owner is

liable to each taxing unit for a penalty in an amount equal to 10 percent of the difference between the amount of tax imposed by the taxing unit on the prop-

erty without the allocation and the amount of tax imposed on the property with the allocation. The chief appraiser shall deliver a written notice of imposition

of the penalty with an explanation to the property owner. The amount of the penalty shall be added to the tax bill at the time and in the manner the collector

collects the tax. The penalty amount constitutes a lien against the property and accrues penalty and interest in the same manner as a delinquent tax.

Verification and Cancellation of Value Allocation: If the chief appraiser learns of any reason indicating that an allocation previously allowed should be

canceled, the chief appraiser shall investigate. If the chief appraiser determines that the property is not entitled to an allocation, the chief appraiser shall

cancel the allocation and deliver written notice of the cancellation not later than the 5th day after the date the chief appraiser makes the cancellation.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-147 • 07-13/2

1

1 2

2 3

3 4

4 5

5