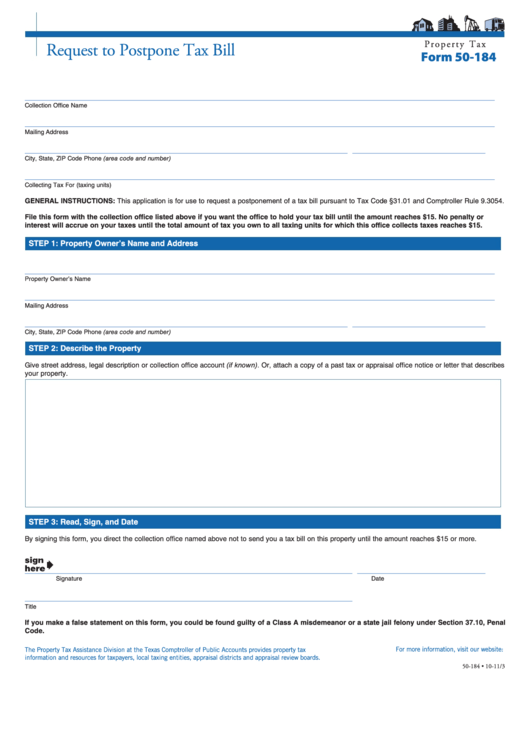

P r o p e r t y T a x

Request to Postpone Tax Bill

Form 50-184

___________________________________________________________________________________________________

Collection Office Name

___________________________________________________________________________________________________

Mailing Address

____________________________________________________________________

____________________________

City, State, ZIP Code

Phone (area code and number)

___________________________________________________________________________________________________

Collecting Tax For (taxing units)

GENERAL INSTRUCTIONS: This application is for use to request a postponement of a tax bill pursuant to Tax Code §31.01 and Comptroller Rule 9.3054.

File this form with the collection office listed above if you want the office to hold your tax bill until the amount reaches $15. No penalty or

interest will accrue on your taxes until the total amount of tax you own to all taxing units for which this office collects taxes reaches $15.

STEP 1: Property Owner’s Name and Address

___________________________________________________________________________________________________

Property Owner’s Name

___________________________________________________________________________________________________

Mailing Address

____________________________________________________________________

____________________________

City, State, ZIP Code

Phone (area code and number)

STEP 2: Describe the Property

Give street address, legal description or collection office account (if known). Or, attach a copy of a past tax or appraisal office notice or letter that describes

your property.

STEP 3: Read, Sign, and Date

By signing this form, you direct the collection office named above not to send you a tax bill on this property until the amount reaches $15 or more.

_____________________________________________________________________

___________________________

Signature

Date

_____________________________________________________________________

Title

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Section 37.10, Penal

Code.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-184 • 10-11/3

1

1