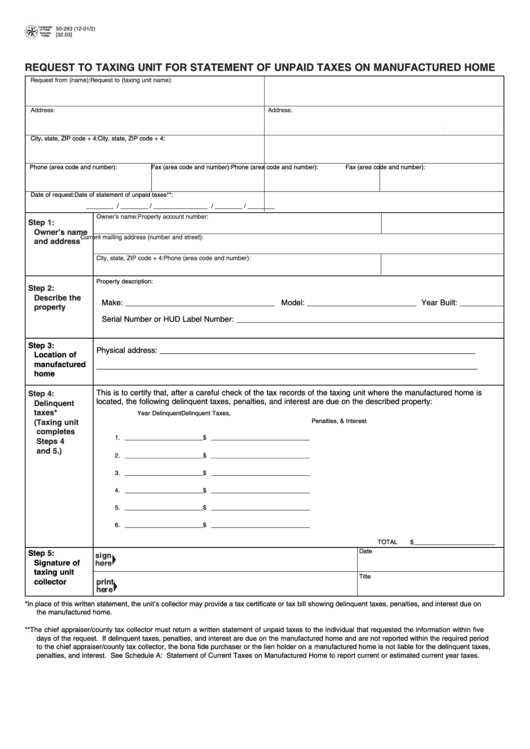

Form 50-293 - Request To Taxing Unit For Statement Of Unpaid Taxes On Manufactured Home

ADVERTISEMENT

Comptroller

50-293 (12-01/2)

T

E

of Public

S

X

Accounts

[32.03]

A

FORM

REQUEST TO TAXING UNIT FOR STATEMENT OF UNPAID TAXES ON MANUFACTURED HOME

Request from (name):

Request to (taxing unit name):

Address:

Address:

City, state, ZIP code + 4:

City, state, ZIP code + 4:

Phone (area code and number):

Fax (area code and number):

Phone (area code and number):

Fax (area code and number):

Date of request:

Date of statement of unpaid taxes**:

________ / ________ / ________

________ / ________ / ________

Owner’s name:

Property account number:

Step 1:

Owner’s name

Current mailing address (number and street):

and address

City, state, ZIP code + 4:

Phone (area code and number):

Property description:

Step 2:

Describe the

Make: __________________________________ Model: _________________________ Year Built: __________

property

Serial Number or HUD Label Number: _____________________________________________________________

Step 3:

Physical address: ________________________________________________________________________

Location of

manufactured

_______________________________________________________________________________________

home

This is to certify that, after a careful check of the tax records of the taxing unit where the manufactured home is

Step 4:

located, the following delinquent taxes, penalties, and interest are due on the described property:

Delinquent

taxes*

Year Delinquent

Delinquent Taxes,

Penalties, & Interest

(Taxing unit

completes

1. _______________________

$ _____________________________

Steps 4

and 5.)

2. _______________________

$ _____________________________

3. _______________________

$ _____________________________

4. _______________________

$ _____________________________

5. _______________________

$ _____________________________

6. _______________________

$ _____________________________

TOTAL

$________________________

Date

Step 5:

Signature of

taxing unit

Title

collector

print

here

*

In place of this written statement, the unit’s collector may provide a tax certificate or tax bill showing delinquent taxes, penalties, and interest due on

the manufactured home.

** The chief appraiser/county tax collector must return a written statement of unpaid taxes to the individual that requested the information within five

days of the request. If delinquent taxes, penalties, and interest are due on the manufactured home and are not reported within the required period

to the chief appraiser/county tax collector, the bona fide purchaser or the lien holder on a manufactured home is not liable for the delinquent taxes,

penalties, and interest. See Schedule A: Statement of Current Taxes on Manufactured Home to report current or estimated current year taxes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1