50-197

(Rev. 09-11/15)

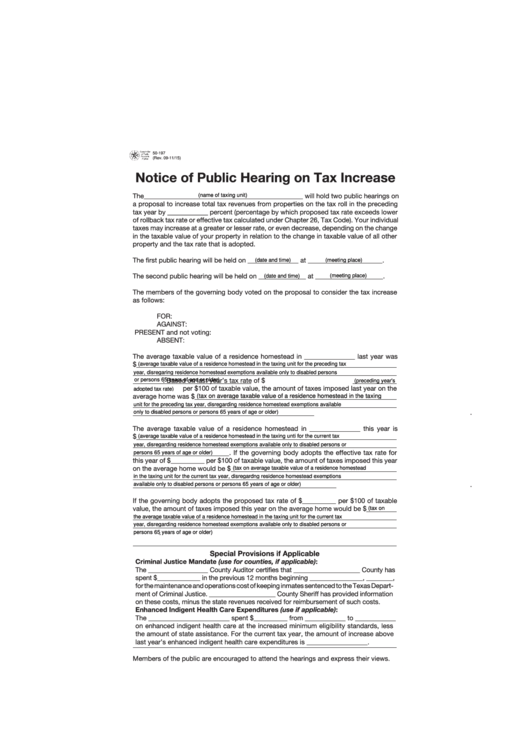

Notice of Public Hearing on Tax Increase

The_______________________________________________ will hold two public hearings on

(name of taxing unit)

a proposal to increase total tax revenues from properties on the tax roll in the preceding

tax year by ____________ percent (percentage by which proposed tax rate exceeds lower

of rollback tax rate or effective tax calculated under Chapter 26, Tax Code). Your individual

taxes may increase at a greater or lesser rate, or even decrease, depending on the change

in the taxable value of your property in relation to the change in taxable value of all other

property and the tax rate that is adopted.

The first public hearing will be held on _______________ at ______________________.

(date and time)

(meeting place)

The second public hearing will be held on ______________ at ____________________.

(meeting place)

(date and time)

The members of the governing body voted on the proposal to consider the tax increase

as follows:

FOR:

AGAINST:

PRESENT and not voting:

ABSENT:

The average taxable value of a residence homestead in _______________ last year was

$

(average taxable value of a residence homestead in the taxing unit for the preceding tax

year, disregaring residence homestead exemptions available only to disabled persons

. Based on last year’s tax rate of $

or persons 65 years of age or older)

(preceding year's

per $100 of taxable value, the amount of taxes imposed last year on the

adopted tax rate)

average home was $

(tax on average taxable value of a residence homestead in the taxing

unit for the preceding tax year, disregarding residence homestead exemptions available

.

only to disabled persons or persons 65 years of age or older)

The average taxable value of a residence homestead in _______________ this year is

$

(average taxable value of a residence homestead in the taxing unti for the current tax

year, disregarding residence homestead exemptions available only to disabled persons or

. If the governing body adopts the effective tax rate for

persons 65 years of age or older)

this year of $__________ per $100 of taxable value, the amount of taxes imposed this year

on the average home would be $

(tax on average taxable value of a residence homestead

in the taxing unit for the current tax year, disregardng residence homestead exemptions

.

available only to disabled persons or persons 65 years of age or older)

If the governing body adopts the proposed tax rate of $__________ per $100 of taxable

value, the amount of taxes imposed this year on the average home would be $

(tax on

the average taxable value of a residence homestead in the taxing unit for the current tax

year, disregarding residence homestead exemptions available only to disabled persons or

.

persons 65 years of age or older)

Special Provisions if Applicable

Criminal Justice Mandate (use for counties, if applicable):

The __________________ County Auditor certifies that ____________________ County has

spent $_____________ in the previous 12 months beginning ________________, ________,

for the maintenance and operations cost of keeping inmates sentenced to the Texas Depart-

ment of Criminal Justice. ____________________ County Sheriff has provided information

on these costs, minus the state revenues received for reimbursement of such costs.

Enhanced Indigent Health Care Expenditures (use if applicable):

The ________________________ spent $__________ from ____________ to ____________

on enhanced indigent health care at the increased minimum eligibility standards, less

the amount of state assistance. For the current tax year, the amount of increase above

last year’s enhanced indigent health care expenditures is __________________.

Members of the public are encouraged to attend the hearings and express their views.

1

1