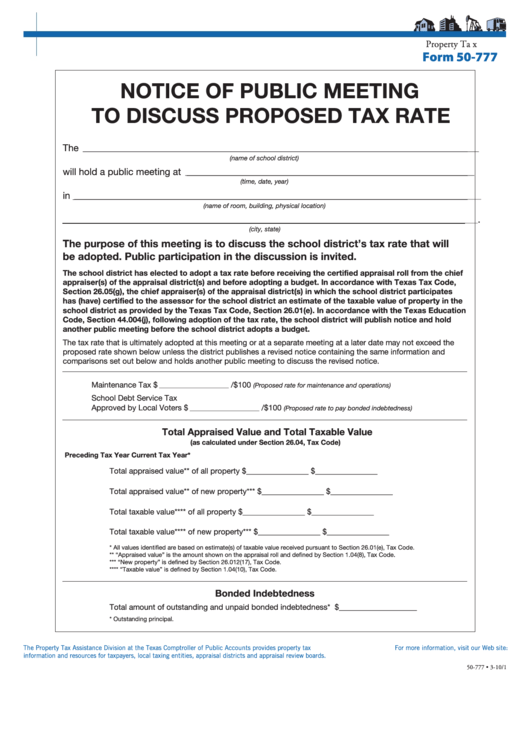

P r o p e r t y T a x

Form 50-777

NOTICE OF PUBLIC MEETING

TO DISCUSS PROPOSED TAX RATE

The

____________________________________________________________________________________________________________________________________________________

(name of school district)

will hold a public meeting at

____________________________________________________________________________________________________________

(time, date, year)

in

________________________________________________________________________________________________________________________________________________________

(name of room, building, physical location)

.

___________________________________________________________________________________________________________________________________________________________

(city, state)

The purpose of this meeting is to discuss the school district’s tax rate that will

be adopted. Public participation in the discussion is invited.

The school district has elected to adopt a tax rate before receiving the certified appraisal roll from the chief

appraiser(s) of the appraisal district(s) and before adopting a budget. In accordance with Texas Tax Code,

Section 26.05(g), the chief appraiser(s) of the appraisal district(s) in which the school district participates

has (have) certified to the assessor for the school district an estimate of the taxable value of property in the

school district as provided by the Texas Tax Code, Section 26.01(e). In accordance with the Texas Education

Code, Section 44.004(j), following adoption of the tax rate, the school district will publish notice and hold

another public meeting before the school district adopts a budget.

The tax rate that is ultimately adopted at this meeting or at a separate meeting at a later date may not exceed the

proposed rate shown below unless the district publishes a revised notice containing the same information and

comparisons set out below and holds another public meeting to discuss the revised notice.

Maintenance Tax

$

/$100

(Proposed rate for maintenance and operations)

__________________________

School Debt Service Tax

Approved by Local Voters

$

/$100

(Proposed rate to pay bonded indebtedness)

__________________________

Total Appraised Value and Total Taxable Value

(as calculated under Section 26.04, Tax Code)

Preceding Tax Year

Current Tax Year*

Total appraised value** of all property

$________________

$________________

Total appraised value** of new property***

$________________

$________________

Total taxable value**** of all property

$________________

$________________

Total taxable value**** of new property***

$________________

$________________

*

All values identified are based on estimate(s) of taxable value received pursuant to Section 26.01(e), Tax Code.

**

“Appraised value” is the amount shown on the appraisal roll and defined by Section 1.04(8), Tax Code.

*** “New property” is defined by Section 26.012(17), Tax Code.

**** “Taxable value” is defined by Section 1.04(10), Tax Code.

Bonded Indebtedness

Total amount of outstanding and unpaid bonded indebtedness* $____________________

* Outstanding principal.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our Web site:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-777 • 3-10/1

1

1 2

2