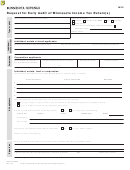

P r o p e r t y T a x

T a x i n g U n i t R e q u e s t f o r P e r f o r m a n c e A u d i t o f A p p r a i s a l D i s t r i c t

Form 50-239

If official action was taken by the governing body, please attach a copy. The requestors represent a majority of the taxing units either

________________________________

Participating in the

Appraisal District, or

Entitled to vote on the appointment of appraisal district directors.

Special Audit (check the item(s) requested to be audited)

CAD compliance with applicable laws

CAD compliance with generally accepted appraisal standards

Duplication of CAD operational effort

General efficiency

Quality of Taxpayer Service

District Personnel Qualifications

________________

Uniformity and level of appraisal overall

Uniformity and level of appraisal by specific category

Effectiveness and efficiency of policies

Effectiveness and efficiency of management

Effectiveness and efficiency of operations

Note: CAD – County Appraisal District

General Audit

A general audit includes a review of:

• the extent to which the district complies with applicable law or generally accepted standards of appraisal or other relevant practice;

• the uniformity and level of appraisal of major kinds of property and the cause of any significant deviations from ideal uniformity and equality of

appraisal of major kinds of property;

• duplication of effort and efficiency of appraisal district operations;

• the general efficiency, quality of service, and qualification of appraisal district personnel.

The comptroller shall complete an audit requested under Section 5.12(b) as soon as practicable after the request is made. The comptroller may not audit

the financial condition of an appraisal district or a district’s tax collections. If the request is for an audit limited to one or more particular matters, the comp-

troller’s audit must be limited to those matters.

The comptroller will conduct an audit according to Texas Property Tax Code Section 5.13 and Comptroller Rule 9.201.

The following person is authorized to represent the above taxing units for this request. All matters pertaining to the audit and requiring communications or

transactions between the Comptroller and the parties making the request will be directed to the taxing units through the designated representative.

_____________________________________________________________________

___________________________

Authorized Agent’s Name

Phone (area code and number)

_____________________________________________________________________

___________________________

Present Mailing Address (number and street)

Email

___________________________________________________________________________________________________

City, State, ZIP Code

For more information, visit our website:

Page 2 • 50-239 • 08-12/2

1

1 2

2