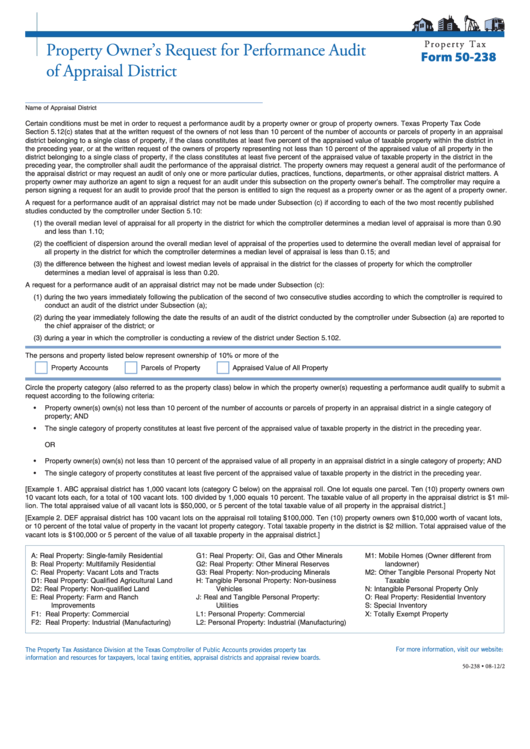

P r o p e r t y T a x

Property Owner’s Request for Performance Audit

Form 50-238

of Appraisal District

__________________________________________________

Name of Appraisal District

Certain conditions must be met in order to request a performance audit by a property owner or group of property owners. Texas Property Tax Code

Section 5.12(c) states that at the written request of the owners of not less than 10 percent of the number of accounts or parcels of property in an appraisal

district belonging to a single class of property, if the class constitutes at least five percent of the appraised value of taxable property within the district in

the preceding year, or at the written request of the owners of property representing not less than 10 percent of the appraised value of all property in the

district belonging to a single class of property, if the class constitutes at least five percent of the appraised value of taxable property in the district in the

preceding year, the comptroller shall audit the performance of the appraisal district. The property owners may request a general audit of the performance of

the appraisal district or may request an audit of only one or more particular duties, practices, functions, departments, or other appraisal district matters. A

property owner may authorize an agent to sign a request for an audit under this subsection on the property owner’s behalf. The comptroller may require a

person signing a request for an audit to provide proof that the person is entitled to sign the request as a property owner or as the agent of a property owner.

A request for a performance audit of an appraisal district may not be made under Subsection (c) if according to each of the two most recently published

studies conducted by the comptroller under Section 5.10:

(1) the overall median level of appraisal for all property in the district for which the comptroller determines a median level of appraisal is more than 0.90

and less than 1.10;

(2) the coefficient of dispersion around the overall median level of appraisal of the properties used to determine the overall median level of appraisal for

all property in the district for which the comptroller determines a median level of appraisal is less than 0.15; and

(3) the difference between the highest and lowest median levels of appraisal in the district for the classes of property for which the comptroller

determines a median level of appraisal is less than 0.20.

A request for a performance audit of an appraisal district may not be made under Subsection (c):

(1) during the two years immediately following the publication of the second of two consecutive studies according to which the comptroller is required to

conduct an audit of the district under Subsection (a);

(2) during the year immediately following the date the results of an audit of the district conducted by the comptroller under Subsection (a) are reported to

the chief appraiser of the district; or

(3) during a year in which the comptroller is conducting a review of the district under Section 5.102.

The persons and property listed below represent ownership of 10% or more of the

Property Accounts

Parcels of Property

Appraised Value of All Property

Circle the property category (also referred to as the property class) below in which the property owner(s) requesting a performance audit qualify to submit a

request according to the following criteria:

• Property owner(s) own(s) not less than 10 percent of the number of accounts or parcels of property in an appraisal district in a single category of

property; AND

• The single category of property constitutes at least five percent of the appraised value of taxable property in the district in the preceding year.

OR

• Property owner(s) own(s) not less than 10 percent of the appraised value of all property in an appraisal district in a single category of property; AND

• The single category of property constitutes at least five percent of the appraised value of taxable property in the district in the preceding year.

[Example 1. ABC appraisal district has 1,000 vacant lots (category C below) on the appraisal roll. One lot equals one parcel. Ten (10) property owners own

10 vacant lots each, for a total of 100 vacant lots. 100 divided by 1,000 equals 10 percent. The taxable value of all property in the appraisal district is $1 mil-

lion. The total appraised value of all vacant lots is $50,000, or 5 percent of the total taxable value of all property in the appraisal district.]

[Example 2. DEF appraisal district has 100 vacant lots on the appraisal roll totaling $100,000. Ten (10) property owners own $10,000 worth of vacant lots,

or 10 percent of the total value of property in the vacant lot property category. Total taxable property in the district is $2 million. Total appraised value of the

vacant lots is $100,000 or 5 percent of the value of all taxable property in the appraisal district.]

A:

Real Property: Single-family Residential

G1: Real Property: Oil, Gas and Other Minerals

M1: Mobile Homes (Owner different from

B:

Real Property: Multifamily Residential

G2: Real Property: Other Mineral Reserves

landowner)

C: Real Property: Vacant Lots and Tracts

G3: Real Property: Non-producing Minerals

M2: Other Tangible Personal Property Not

D1: Real Property: Qualified Agricultural Land

H: Tangible Personal Property: Non-business

Taxable

D2: Real Property: Non-qualified Land

Vehicles

N: Intangible Personal Property Only

E:

Real Property: Farm and Ranch

J:

Real and Tangible Personal Property:

O: Real Property: Residential Inventory

Improvements

Utilities

S:

Special Inventory

F1: Real Property: Commercial

L1: Personal Property: Commercial

X:

Totally Exempt Property

F2: Real Property: Industrial (Manufacturing)

L2: Personal Property: Industrial (Manufacturing)

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-238 • 08-12/2

1

1 2

2 3

3