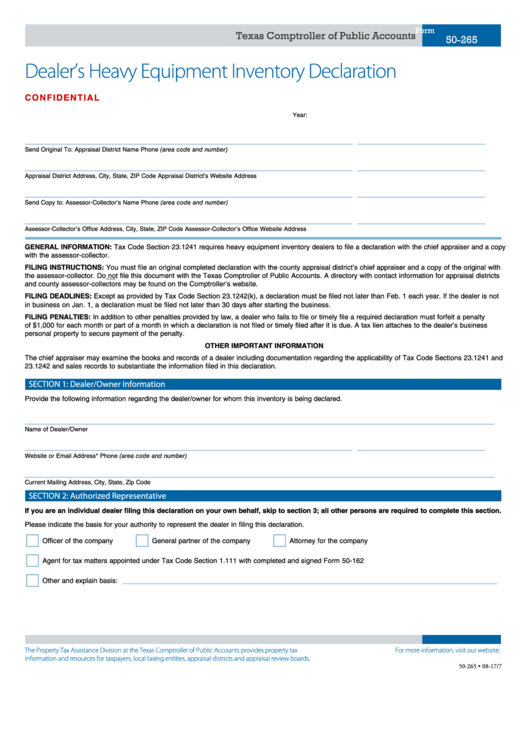

Form

Texas Comptroller of Public Accounts

50-265

Dealer’s Heavy Equipment Inventory Declaration

C O N F I D E N T I A L

__________

_________

_________

Year:

Page

of Pages

_____________________________________________________________________

___________________________

Send Original To: Appraisal District Name

Phone (area code and number)

_____________________________________________________________________

___________________________

Appraisal District Address, City, State, ZIP Code

Appraisal District’s Website Address

_____________________________________________________________________

___________________________

Send Copy to: Assessor-Collector’s Name

Phone (area code and number)

_____________________________________________________________________

___________________________

Assessor-Collector’s Office Address, City, State, ZIP Code

Assessor-Collector’s Office Website Address

GENERAL INFORMATION: Tax Code Section 23.1241 requires heavy equipment inventory dealers to file a declaration with the chief appraiser and a copy

with the assessor-collector.

FILING INSTRUCTIONS: You must file an original completed declaration with the county appraisal district’s chief appraiser and a copy of the original with

the assessor-collector. Do not file this document with the Texas Comptroller of Public Accounts. A directory with contact information for appraisal districts

and county assessor-collectors may be found on the Comptroller’s website.

FILING DEADLINES: Except as provided by Tax Code Section 23.1242(k), a declaration must be filed not later than Feb. 1 each year. If the dealer is not

in business on Jan. 1, a declaration must be filed not later than 30 days after starting the business.

FILING PENALTIES: In addition to other penalties provided by law, a dealer who fails to file or timely file a required declaration must forfeit a penalty

of $1,000 for each month or part of a month in which a declaration is not filed or timely filed after it is due. A tax lien attaches to the dealer’s business

personal property to secure payment of the penalty.

OTHER IMPORTANT INFORMATION

The chief appraiser may examine the books and records of a dealer including documentation regarding the applicability of Tax Code Sections 23.1241 and

23.1242 and sales records to substantiate the information filed in this declaration.

SECTION 1: Dealer/Owner Information

Provide the following information regarding the dealer/owner for whom this inventory is being declared.

___________________________________________________________________________________________________

Name of Dealer/Owner

_____________________________________________________________________

___________________________

Website or Email Address*

Phone (area code and number)

___________________________________________________________________________________________________

Current Mailing Address, City, State, Zip Code

SECTION 2: Authorized Representative

If you are an individual dealer filing this declaration on your own behalf, skip to section 3; all other persons are required to complete this section.

Please indicate the basis for your authority to represent the dealer in filing this declaration.

£

£

£

Officer of the company

General partner of the company

Attorney for the company

£

Agent for tax matters appointed under Tax Code Section 1.111 with completed and signed Form 50-162

£

_______________________________________________________________________________

Other and explain basis:

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

comptroller.texas.gov/taxes/property-tax

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-265 • 08-17/7

1

1 2

2 3

3