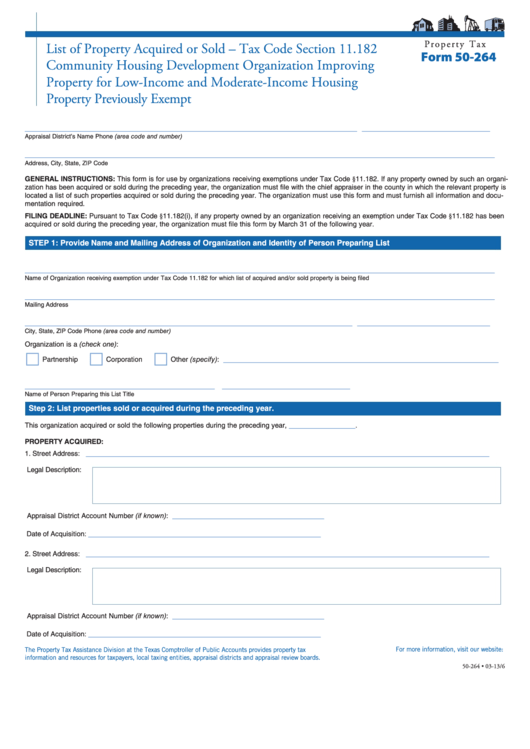

P r o p e r t y T a x

List of Property Acquired or Sold – Tax Code Section 11.182

Form 50-264

Community Housing Development Organization Improving

Property for Low-Income and Moderate-Income Housing

Property Previously Exempt

______________________________________________________________________

___________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Address, City, State, ZIP Code

GENERAL INSTRUCTIONS: This form is for use by organizations receiving exemptions under Tax Code §11.182. If any property owned by such an organi-

zation has been acquired or sold during the preceding year, the organization must file with the chief appraiser in the county in which the relevant property is

located a list of such properties acquired or sold during the preceding year. The organization must use this form and must furnish all information and docu-

mentation required.

FILING DEADLINE: Pursuant to Tax Code §11.182(i), if any property owned by an organization receiving an exemption under Tax Code §11.182 has been

acquired or sold during the preceding year, the organization must file this form by March 31 of the following year.

STEP 1: Provide Name and Mailing Address of Organization and Identity of Person Preparing List

___________________________________________________________________________________________________

Name of Organization receiving exemption under Tax Code 11.182 for which list of acquired and/or sold property is being filed

___________________________________________________________________________________________________

Mailing Address

_____________________________________________________________________

____________________________

City, State, ZIP Code

Phone (area code and number)

Organization is a (check one):

__________________________________________________________

Partnership

Corporation

Other (specify):

________________________________________

___________________________

Name of Person Preparing this List

Title

Step 2: List properties sold or acquired during the preceding year.

______________

This organization acquired or sold the following properties during the preceding year,

.

PROPERTY ACQUIRED:

_____________________________________________________________________________________

1. Street Address:

Legal Description:

________________________________

Appraisal District Account Number (if known):

_________________________________________________

Date of Acquisition:

_____________________________________________________________________________________

2. Street Address:

Legal Description:

________________________________

Appraisal District Account Number (if known):

_________________________________________________

Date of Acquisition:

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-264 • 03-13/6

1

1 2

2