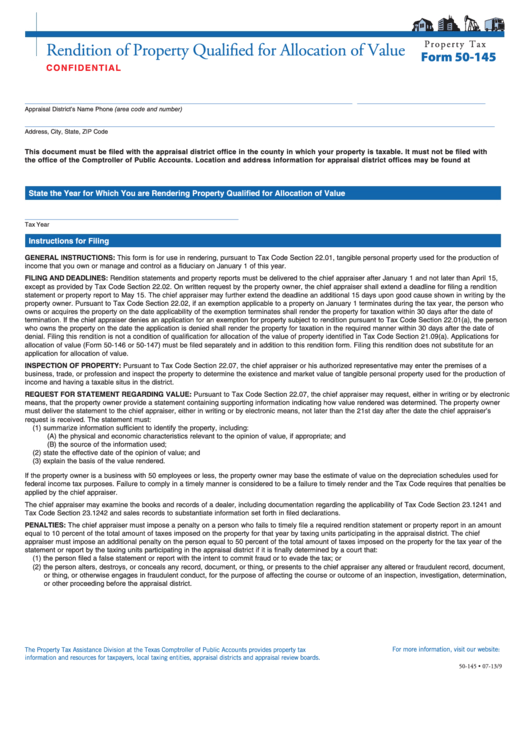

P r o p e r t y T a x

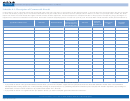

Rendition of Property Qualified for Allocation of Value

Form 50-145

C O N F I D E N T I A L

_____________________________________________________________________

___________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Address, City, State, ZIP Code

This document must be filed with the appraisal district office in the county in which your property is taxable. It must not be filed with

the office of the Comptroller of Public Accounts. Location and address information for appraisal district offices may be found at

State the Year for Which You are Rendering Property Qualified for Allocation of Value

_____________________________________________

Tax Year

Instructions for Filing

GENERAL INSTRUCTIONS: This form is for use in rendering, pursuant to Tax Code Section 22.01, tangible personal property used for the production of

income that you own or manage and control as a fiduciary on January 1 of this year.

FILING AND DEADLINES: Rendition statements and property reports must be delivered to the chief appraiser after January 1 and not later than April 15,

except as provided by Tax Code Section 22.02. On written request by the property owner, the chief appraiser shall extend a deadline for filing a rendition

statement or property report to May 15. The chief appraiser may further extend the deadline an additional 15 days upon good cause shown in writing by the

property owner. Pursuant to Tax Code Section 22.02, if an exemption applicable to a property on January 1 terminates during the tax year, the person who

owns or acquires the property on the date applicability of the exemption terminates shall render the property for taxation within 30 days after the date of

termination. If the chief appraiser denies an application for an exemption for property subject to rendition pursuant to Tax Code Section 22.01(a), the person

who owns the property on the date the application is denied shall render the property for taxation in the required manner within 30 days after the date of

denial. Filing this rendition is not a condition of qualification for allocation of the value of property identified in Tax Code Section 21.09(a). Applications for

allocation of value (Form 50-146 or 50-147) must be filed separately and in addition to this rendition form. Filing this rendition does not substitute for an

application for allocation of value.

INSPECTION OF PROPERTY: Pursuant to Tax Code Section 22.07, the chief appraiser or his authorized representative may enter the premises of a

business, trade, or profession and inspect the property to determine the existence and market value of tangible personal property used for the production of

income and having a taxable situs in the district.

REQUEST FOR STATEMENT REGARDING VALUE: Pursuant to Tax Code Section 22.07, the chief appraiser may request, either in writing or by electronic

means, that the property owner provide a statement containing supporting information indicating how value rendered was determined. The property owner

must deliver the statement to the chief appraiser, either in writing or by electronic means, not later than the 21st day after the date the chief appraiser’s

request is received. The statement must:

(1) summarize information sufficient to identify the property, including:

(A) the physical and economic characteristics relevant to the opinion of value, if appropriate; and

(B) the source of the information used;

(2) state the effective date of the opinion of value; and

(3) explain the basis of the value rendered.

If the property owner is a business with 50 employees or less, the property owner may base the estimate of value on the depreciation schedules used for

federal income tax purposes. Failure to comply in a timely manner is considered to be a failure to timely render and the Tax Code requires that penalties be

applied by the chief appraiser.

The chief appraiser may examine the books and records of a dealer, including documentation regarding the applicability of Tax Code Section 23.1241 and

Tax Code Section 23.1242 and sales records to substantiate information set forth in filed declarations.

PENALTIES: The chief appraiser must impose a penalty on a person who fails to timely file a required rendition statement or property report in an amount

equal to 10 percent of the total amount of taxes imposed on the property for that year by taxing units participating in the appraisal district. The chief

appraiser must impose an additional penalty on the person equal to 50 percent of the total amount of taxes imposed on the property for the tax year of the

statement or report by the taxing units participating in the appraisal district if it is finally determined by a court that:

(1) the person filed a false statement or report with the intent to commit fraud or to evade the tax; or

(2) the person alters, destroys, or conceals any record, document, or thing, or presents to the chief appraiser any altered or fraudulent record, document,

or thing, or otherwise engages in fraudulent conduct, for the purpose of affecting the course or outcome of an inspection, investigation, determination,

or other proceeding before the appraisal district.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-145 • 07-13/9

1

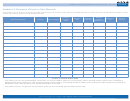

1 2

2 3

3 4

4 5

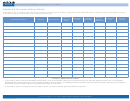

5 6

6 7

7 8

8