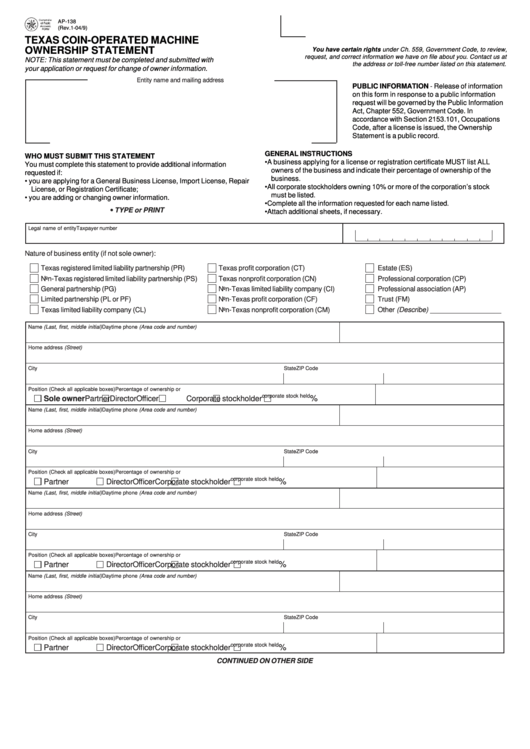

AP-138

(Rev.1-04/9)

TEXAS COIN-OPERATED MACHINE

OWNERSHIP STATEMENT

You have certain rights under Ch. 559, Government Code, to review,

request, and correct information we have on file about you. Contact us at

NOTE: This statement must be completed and submitted with

the address or toll-free number listed on this statement.

your application or request for change of owner information.

Entity name and mailing address

PUBLIC INFORMATION - Release of information

on this form in response to a public information

request will be governed by the Public Information

Act, Chapter 552, Government Code. In

accordance with Section 2153.101, Occupations

Code, after a license is issued, the Ownership

Statement is a public record.

GENERAL INSTRUCTIONS

WHO MUST SUBMIT THIS STATEMENT

• A business applying for a license or registration certificate MUST list ALL

You must complete this statement to provide additional information

owners of the business and indicate their percentage of ownership of the

requested if:

business.

• you are applying for a General Business License, Import License, Repair

• All corporate stockholders owning 10% or more of the corporation’s stock

License, or Registration Certificate;

must be listed.

• you are adding or changing owner information.

• Complete all the information requested for each name listed.

• TYPE or PRINT

• Attach additional sheets, if necessary.

Legal name of entity

Taxpayer number

Nature of business entity (if not sole owner):

Texas registered limited liability partnership (PR)

Texas profit corporation (CT)

Estate (ES)

Non-Texas registered limited liability partnership (PS)

Texas nonprofit corporation (CN)

Professional corporation (CP)

General partnership (PG)

Non-Texas limited liability company (CI)

Professional association (AP)

Limited partnership (PL or PF)

Non-Texas profit corporation (CF)

Trust (FM)

Texas limited liability company (CL)

Non-Texas nonprofit corporation (CM)

Other (Describe)

Name (Last, first, middle initial)

Daytime phone (Area code and number)

Home address (Street)

City

State

ZIP Code

Position (Check all applicable boxes)

Percentage of ownership or

corporate stock held

%

Sole owner

Partner

Director

Officer

Corporate stockholder

Name (Last, first, middle initial)

Daytime phone (Area code and number)

Home address (Street)

City

State

ZIP Code

Position (Check all applicable boxes)

Percentage of ownership or

corporate stock held

%

Partner

Director

Officer

Corporate stockholder

Name (Last, first, middle initial)

Daytime phone (Area code and number)

Home address (Street)

City

State

ZIP Code

Position (Check all applicable boxes)

Percentage of ownership or

corporate stock held

%

Partner

Director

Officer

Corporate stockholder

Name (Last, first, middle initial)

Daytime phone (Area code and number)

Home address (Street)

City

State

ZIP Code

Position (Check all applicable boxes)

Percentage of ownership or

corporate stock held

%

Partner

Director

Officer

Corporate stockholder

CONTINUED ON OTHER SIDE

1

1 2

2