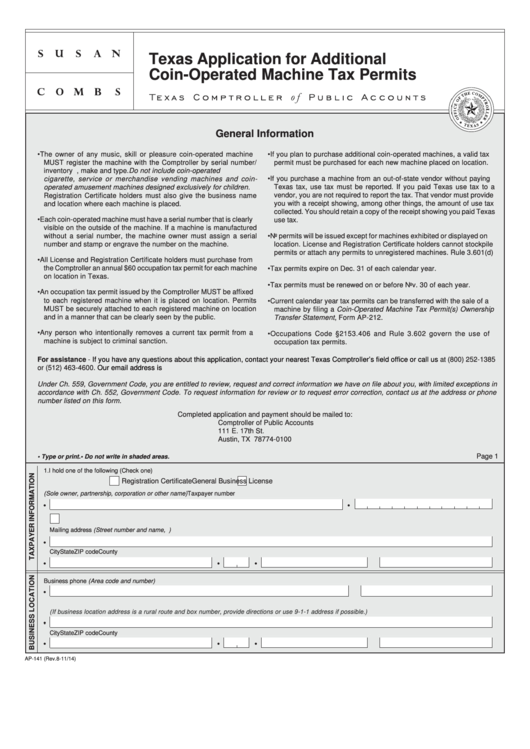

Texas Application for Additional

Coin-Operated Machine Tax Permits

General Information

• The owner of any music, skill or pleasure coin-operated machine

• If you plan to purchase additional coin-operated machines, a valid tax

MUST register the machine with the Comptroller by serial number/

permit must be purchased for each new machine placed on location.

inventory I.D. number, make and type. Do not include coin-operated

• If you purchase a machine from an out-of-state vendor without paying

cigarette, service or merchandise vending machines and coin-

Texas tax, use tax must be reported. If you paid Texas use tax to a

operated amusement machines designed exclusively for children.

vendor, you are not required to report the tax. That vendor must provide

Registration Certificate holders must also give the business name

you with a receipt showing, among other things, the amount of use tax

and location where each machine is placed.

collected. You should retain a copy of the receipt showing you paid Texas

• Each coin-operated machine must have a serial number that is clearly

use tax.

visible on the outside of the machine. If a machine is manufactured

without a serial number, the machine owner must assign a serial

• No permits will be issued except for machines exhibited or displayed on

number and stamp or engrave the number on the machine.

location. License and Registration Certificate holders cannot stockpile

permits or attach any permits to unregistered machines. Rule 3.601(d)

• All License and Registration Certificate holders must purchase from

the Comptroller an annual $60 occupation tax permit for each machine

• Tax permits expire on Dec. 31 of each calendar year.

on location in Texas.

• Tax permits must be renewed on or before Nov. 30 of each year.

• An occupation tax permit issued by the Comptroller MUST be affixed

to each registered machine when it is placed on location. Permits

• Current calendar year tax permits can be transferred with the sale of a

MUST be securely attached to each registered machine on location

machine by filing a Coin-Operated Machine Tax Permit(s) Ownership

and in a manner that can be clearly seen by the public.

Transfer Statement, Form AP-212.

• Any person who intentionally removes a current tax permit from a

• Occupations Code §2153.406 and Rule 3.602 govern the use of

machine is subject to criminal sanction.

occupation tax permits.

For assistance -

If you have any questions about this application, contact your nearest Texas Comptroller’s field office or call us

at (800) 252-1385

or (512) 463-4600.

Our email address is tax.help@cpa.state.tx.us.

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about you, with limited exceptions in

accordance with Ch. 552, Government Code. To request information for review or to request error correction, contact us at the address or phone

number listed on this form.

Completed application and payment should be mailed to:

Comptroller of Public Accounts

111 E. 17th St.

Austin, TX 78774-0100

Page 1

• Type or print.

• Do not write in shaded areas.

1. I hold one of the following (Check one)

Registration Certificate

General Business License

2. Legal name of owner (Sole owner, partnership, corporation or other name)

Taxpayer number

3.

Check here if there has been a change in your mailing address. Enter the correct address.

Mailing address (Street number and name, P.O. Box or rural route and box no.)

City

State

ZIP code

County

4. Trade name of business/machine location

Business phone (Area code and number)

5. Location of business / machine location

(If business location address is a rural route and box number, provide directions or use 9-1-1 address if possible.)

City

State

ZIP code

County

AP-141 (Rev.8-11/14)

1

1 2

2