Form Ct-3911 - Taxpayer Statement Regarding State Of Connecticut Tax Refund

ADVERTISEMENT

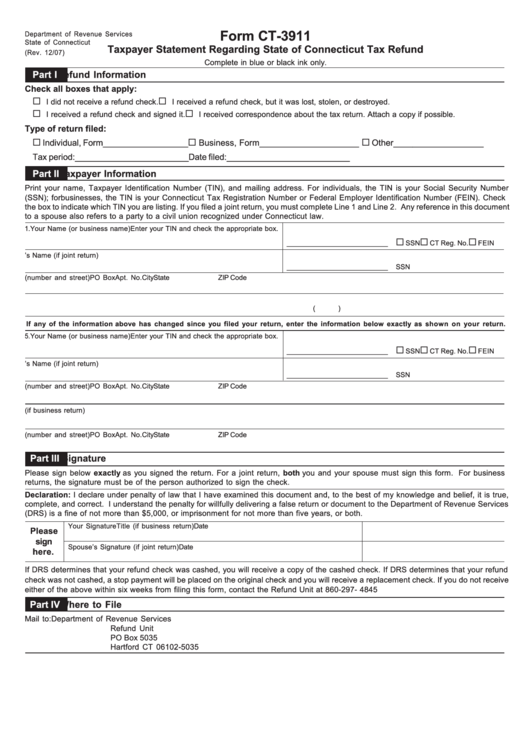

Form CT-3911

Department of Revenue Services

State of Connecticut

Taxpayer Statement Regarding State of Connecticut Tax Refund

(Rev. 12/07)

Complete in blue or black ink only.

Part I

Refund Information

Check all boxes that apply:

Q

Q

I did not receive a refund check.

I received a refund check, but it was lost, stolen, or destroyed.

Q

Q

I received a refund check and signed it.

I received correspondence about the tax return. Attach a copy if possible.

Type of return filed:

Q

Q

Q

Individual, Form __________________

Business, Form _____________________

Other ___________________

Tax period: ________________________ Date filed: __________________________

Part II

Taxpayer Information

Print your name, Taxpayer Identification Number (TIN), and mailing address. For individuals, the TIN is your Social Security Number

(SSN); for businesses, the TIN is your Connecticut Tax Registration Number or Federal Employer Identification Number (FEIN). Check

the box to indicate which TIN you are listing. If you filed a joint return, you must complete Line 1 and Line 2. Any reference in this document

to a spouse also refers to a party to a civil union recognized under Connecticut law.

1. Your Name (or business name)

Enter your TIN and check the appropriate box.

Q

Q

Q

__________________________

SSN

CT Reg. No.

FEIN

2. Spouse’s Name (if joint return)

__________________________

SSN

3. Address (number and street)

PO Box

Apt. No.

City

State

ZIP Code

4. Telephone number where you can be reached between 8 a.m. and 5 p.m.

Daytime Telephone Number

(

)

If any of the information above has changed since you filed your return, enter the information below exactly as shown on your return.

5. Your Name (or business name)

Enter your TIN and check the appropriate box.

Q

Q

Q

__________________________

SSN

CT Reg. No.

FEIN

6. Spouse’s Name (if joint return)

__________________________

SSN

7. Address (number and street)

PO Box

Apt. No.

City

State

ZIP Code

8. Name of individual making the request if different from above.

Relationship to above individual or title (if business return)

9. Address (number and street)

PO Box

Apt. No.

City

State

ZIP Code

Part III

Signature

Please sign below exactly as you signed the return. For a joint return, both you and your spouse must sign this form. For business

returns, the signature must be of the person authorized to sign the check.

Declaration: I declare under penalty of law that I have examined this document and, to the best of my knowledge and belief, it is true,

complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department of Revenue Services

(DRS) is a fine of not more than $5,000, or imprisonment for not more than five years, or both.

Your Signature

Title (if business return)

Date

Please

sign

Spouse’s Signature (if joint return)

Date

here.

If DRS determines that your refund check was cashed, you will receive a copy of the cashed check. If DRS determines that your refund

check was not cashed, a stop payment will be placed on the original check and you will receive a replacement check. If you do not receive

either of the above within six weeks from filing this form, contact the Refund Unit at 860-297- 4845.

Part IV

Where to File

Mail to:

Department of Revenue Services

Refund Unit

PO Box 5035

Hartford CT 06102-5035

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1