Schedule Ct-1041b - Fiduciary Adjustment Allocation - 2013

ADVERTISEMENT

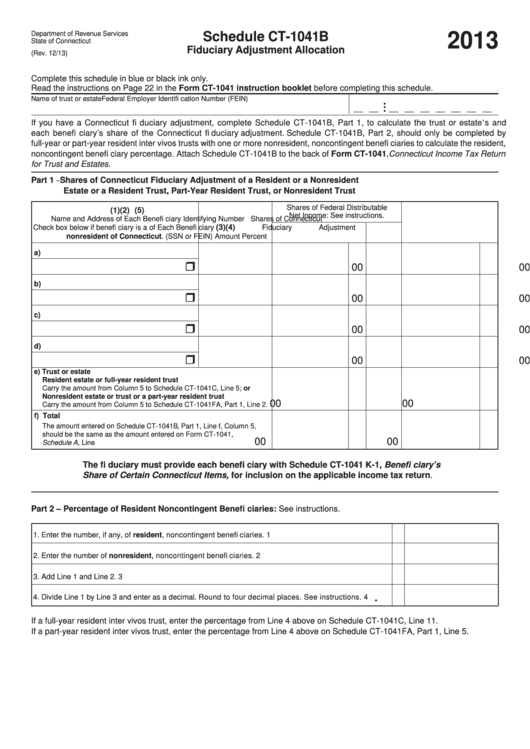

Department of Revenue Services

Schedule CT-1041B

2013

State of Connecticut

Fiduciary Adjustment Allocation

(Rev. 12/13)

Complete this schedule in blue or black ink only.

Read the instructions on Page 22 in the Form CT-1041 instruction booklet before completing this schedule.

Name of trust or estate

Federal Employer Identifi cation Number (FEIN)

•

__ __

•

__ __ __ __ __ __ __

•

If you have a Connecticut fi duciary adjustment, complete Schedule CT-1041B, Part 1, to calculate the trust or estate’s and

each benefi ciary’s share of the Connecticut fi duciary adjustment. Schedule CT-1041B, Part 2, should only be completed by

full-year or part-year resident inter vivos trusts with one or more nonresident, noncontingent benefi ciaries to calculate the resident,

noncontingent benefi ciary percentage. Attach Schedule CT-1041B to the back of Form CT-1041, Connecticut Income Tax Return

for Trust and Estates.

Part 1 – Shares of Connecticut Fiduciary Adjustment of a Resident or a Nonresident

Estate or a Resident Trust, Part-Year Resident Trust, or Nonresident Trust

Shares of Federal Distributable

(1)

(2)

(5)

Net Income: See instructions.

Name and Address of Each Benefi ciary

Identifying Number

Shares of Connecticut

(3)

(4)

Check box below if benefi ciary is a

of Each Benefi ciary

Fiduciary Adjustment

nonresident of Connecticut.

(SSN or FEIN)

Amount

Percent

a)

00

00

b)

00

00

c)

00

00

d)

00

00

e) Trust or estate

Resident estate or full-year resident trust

Carry the amount from Column 5 to Schedule CT-1041C, Line 5; or

Nonresident estate or trust or a part-year resident trust

00

00

Carry the amount from Column 5 to Schedule CT-1041FA, Part 1, Line 2.

f) Total

The amount entered on Schedule CT-1041B, Part 1, Line f, Column 5,

should be the same as the amount entered on Form CT-1041,

00

00

Schedule A, Line 13. See instructions.

The fi duciary must provide each benefi ciary with Schedule CT-1041 K-1, Benefi ciary’s

Share of Certain Connecticut Items, for inclusion on the applicable income tax return.

Part 2 – Percentage of Resident Noncontingent Benefi ciaries: See instructions.

1.

Enter the number, if any, of resident, noncontingent benefi ciaries.

1

2.

Enter the number of nonresident, noncontingent benefi ciaries.

2

3.

Add Line 1 and Line 2.

3

4.

Divide Line 1 by Line 3 and enter as a decimal. Round to four decimal places. See instructions.

4

•

If a full-year resident inter vivos trust, enter the percentage from Line 4 above on Schedule CT-1041C, Line 11.

If a part-year resident inter vivos trust, enter the percentage from Line 4 above on Schedule CT-1041FA, Part 1, Line 5.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1