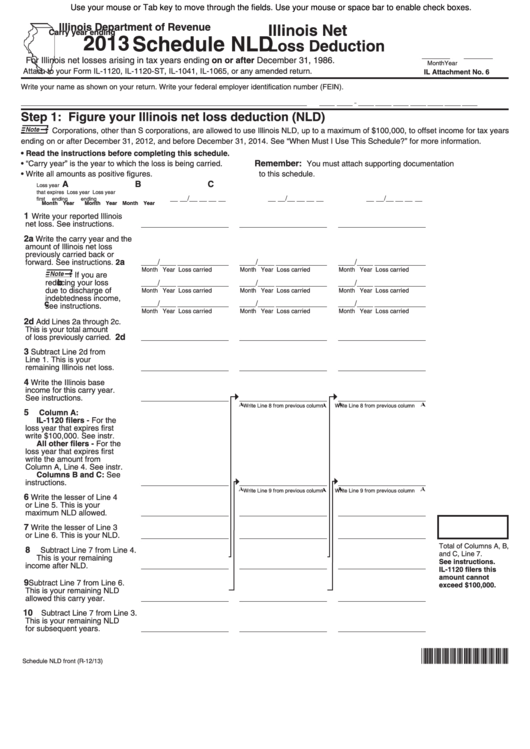

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Illinois Net

Carry year ending

2013 Schedule NLD

Loss Deduction

For Illinois net losses arising in tax years ending on or after December 31, 1986.

Month

Year

Attach to your Form IL-1120, IL-1120-ST, IL-1041, IL-1065, or any amended return.

IL Attachment No. 6

Write your name as shown on your return.

Write your federal employer identification number (FEIN).

Step 1: Figure your Illinois net loss deduction (NLD)

Corporations, other than S corporations, are allowed to use Illinois NLD, up to a maximum of $100,000, to offset income for tax years

ending on or after December 31, 2012, and before December 31, 2014. See “When Must I Use This Schedule?” for more information.

•

Read the instructions before completing this schedule.

Remember:

•

“Carry year” is the year to which the loss is being carried.

You must attach supporting documentation

•

Write all amounts as positive figures.

to this schedule.

A

B

C

Loss year

that expires

Loss year

Loss year

first

ending

ending

Month

Year

Month

Year

Month

Year

1

Write your reported Illinois

net loss. See instructions.

2a

Write the carry year and the

amount of Illinois net loss

previously carried back or

a

forward. See instructions. 2

Month Year Loss carried

Month Year Loss carried

Month Year Loss carried

If you are

b

reducing your loss

due to discharge of

Month Year Loss carried

Month Year Loss carried

Month Year Loss carried

indebtedness income,

c

see instructions.

Month Year Loss carried

Month Year Loss carried

Month Year Loss carried

2d

Add Lines 2a through 2c.

This is your total amount

2d

of loss previously carried.

3

Subtract Line 2d from

Line 1. This is your

remaining Illinois net loss.

4

Write the Illinois base

income for this carry year.

See instructions.

Write Line 8 from previous column

Write Line 8 from previous column

5

Column A:

IL-1120 filers - For the

loss year that expires first

write $100,000. See instr.

All other filers - For the

loss year that expires first

write the amount from

Column A, Line 4. See instr.

Columns B and C: See

instructions.

Write Line 9 from previous column

Write Line 9 from previous column

6

Write the lesser of Line 4

or Line 5. This is your

maximum NLD allowed.

7

Write the lesser of Line 3

or Line 6. This is your NLD.

Total of Columns A, B,

8

Subtract Line 7 from Line 4.

and C, Line 7.

This is your remaining

See instructions.

income after NLD.

IL-1120 filers this

amount cannot

9

Subtract Line 7 from Line 6.

exceed $100,000.

This is your remaining NLD

allowed this carry year.

10

Subtract Line 7 from Line 3.

This is your remaining NLD

for subsequent years.

*333201110*

Schedule NLD front (R-12/13)

1

1 2

2