Form Ct-8379 - Nonobligated Spouse Claim - Connecticut Department Of Revenue - 2014

ADVERTISEMENT

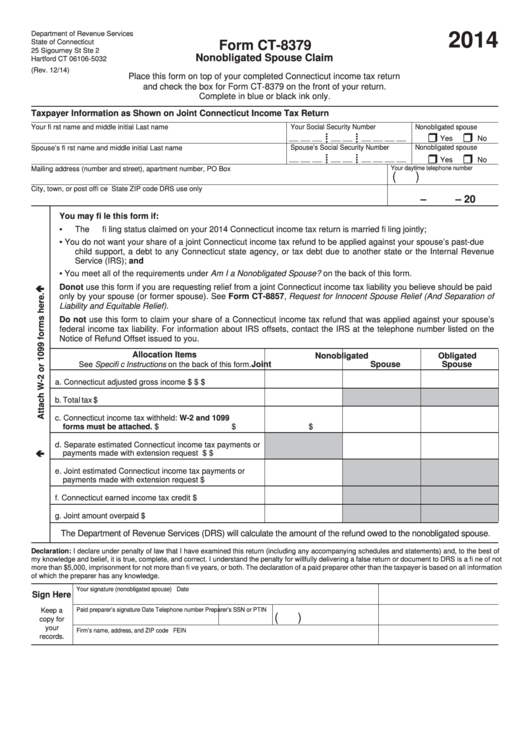

Department of Revenue Services

2014

State of Connecticut

Form CT-8379

25 Sigourney St Ste 2

Nonobligated Spouse Claim

Hartford CT 06106-5032

(Rev. 12/14)

Place this form on top of your completed Connecticut income tax return

and check the box for Form CT-8379 on the front of your return.

Complete in blue or black ink only.

Taxpayer Information as Shown on Joint Connecticut Income Tax Return

Your Social Security Number

Your fi rst name and middle initial

Last name

Nonobligated spouse

• •

• •

__ __ __

__ __

__ __ __ __

Yes

No

• •

• •

Nonobligated spouse

Spouse’s Social Security Number

Spouse’s fi rst name and middle initial

Last name

• •

• •

__ __ __

__ __

__ __ __ __

Yes

No

• •

• •

Your daytime telephone number

Mailing address (number and street), apartment number, PO Box

(

)

City, town, or post offi ce

State

ZIP code

DRS use only

–

– 20

You may fi le this form if:

•

The fi ling status claimed on your 2014 Connecticut income tax return is married fi ling jointly;

You do not want your share of a joint Connecticut income tax refund to be applied against your spouse’s past-due

•

child support, a debt to any Connecticut state agency, or tax debt due to another state or the Internal Revenue

Service (IRS); and

You meet all of the requirements under Am I a Nonobligated Spouse? on the back of this form.

•

Do not use this form if you are requesting relief from a joint Connecticut income tax liability you believe should be paid

only by your spouse (or former spouse). See Form CT-8857, Request for Innocent Spouse Relief (And Separation of

Liability and Equitable Relief).

Do not use this form to claim your share of a Connecticut income tax refund that was applied against your spouse’s

federal income tax liability. For information about IRS offsets, contact the IRS at the telephone number listed on the

Notice of Refund Offset issued to you.

Allocation Items

Nonobligated

Obligated

See Specifi c Instructions on the back of this form.

Joint

Spouse

Spouse

a. Connecticut adjusted gross income

$

$

$

b. Total tax

$

c. Connecticut income tax withheld: W-2 and 1099

forms must be attached.

$

$

$

d. Separate estimated Connecticut income tax payments or

payments made with extension request

$

$

e. Joint estimated Connecticut income tax payments or

payments made with extension request

$

f. Connecticut earned income tax credit

$

g. Joint amount overpaid

$

The Department of Revenue Services (DRS) will calculate the amount of the refund owed to the nonobligated spouse.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fi ne of not

more than $5,000, imprisonment for not more than fi ve years, or both. The declaration of a paid preparer other than the taxpayer is based on all information

of which the preparer has any knowledge.

Your signature (nonobligated spouse)

Date

Sign Here

Keep a

Paid preparer’s signature

Date

Telephone number

Preparer’s SSN or PTIN

(

)

copy for

your

Firm’s name, address, and ZIP code

FEIN

records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2