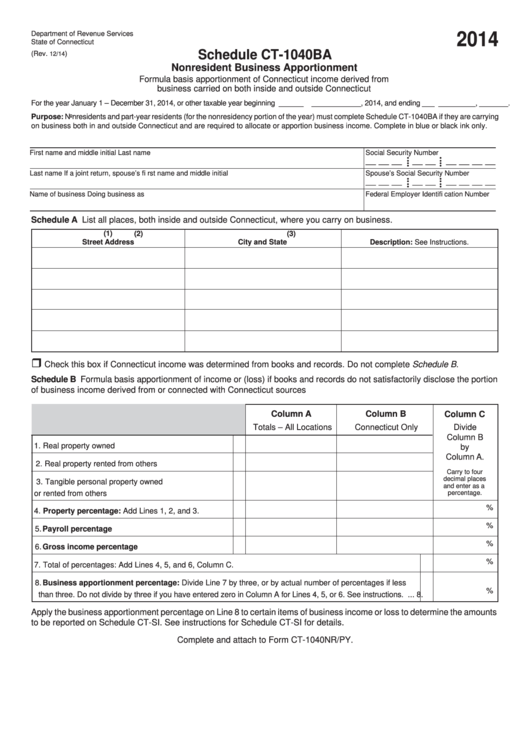

Department of Revenue Services

2014

State of Connecticut

Schedule CT-1040BA

(Rev.

)

12/14

Nonresident Business Apportionment

Formula basis apportionment of Connecticut income derived from

business carried on both inside and outside Connecticut

For the year January 1 – December 31, 2014, or other taxable year beginning ______ ____________, 2014, and ending ___ _________, _______.

Purpose: Nonresidents and part-year residents (for the nonresidency portion of the year) must complete Schedule CT-1040BA if they are carrying

on business both in and outside Connecticut and are required to allocate or apportion business income. Complete in blue or black ink only.

First name and middle initial

Last name

Social Security Number

• •

• •

__ __ __ __ __ __ __ __ __

• •

• •

Last name If a joint return, spouse’s fi rst name and middle initial

Spouse’s Social Security Number

• •

• •

__ __ __ __ __ __ __ __ __

• •

• •

Name of business

Doing business as

Federal Employer Identifi cation Number

Schedule A List all places, both inside and outside Connecticut, where you carry on business.

(1)

(2)

(3)

Street Address

City and State

Description: See Instructions.

Check this box if Connecticut income was determined from books and records. Do not complete Schedule B.

Schedule B Formula basis apportionment of income or (loss) if books and records do not satisfactorily disclose the portion

of business income derived from or connected with Connecticut sources

Column A

Column B

Column C

Totals – All Locations

Connecticut Only

Divide

Column B

1. Real property owned ..................................................... 1.

by

Column A.

2. Real property rented from others .................................. 2.

Carry to four

decimal places

3. Tangible personal property owned

and enter as a

or rented from others .................................................... 3.

percentage.

%

4. Property percentage: Add Lines 1, 2, and 3. ............. 4.

%

5. Payroll percentage ..................................................... 5.

%

6. Gross income percentage ......................................... 6.

%

7. Total of percentages: Add Lines 4, 5, and 6, Column C. .................................................................................... 7.

8. Business apportionment percentage: Divide Line 7 by three, or by actual number of percentages if less

%

than three. Do not divide by three if you have entered zero in Column A for Lines 4, 5, or 6. See instructions. ... 8.

Apply the business apportionment percentage on Line 8 to certain items of business income or loss to determine the amounts

to be reported on Schedule CT-SI. See instructions for Schedule CT-SI for details.

Complete and attach to Form CT-1040NR/PY.

1

1 2

2 3

3