Form Et-30 - Application For Release(S) Of Estate Tax Lien

ADVERTISEMENT

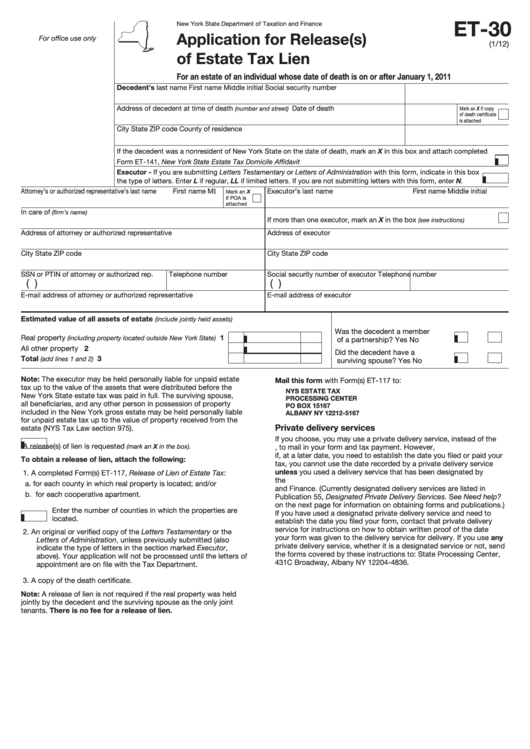

ET-30

New York State Department of Taxation and Finance

Application for Release(s)

For office use only

(1/12)

of Estate Tax Lien

For an estate of an individual whose date of death is on or after January 1, 2011

Decedent’s last name

First name

Middle initial

Social security number

Address of decedent at time of death

Date of death

(number and street)

Mark an X if copy

of death certificate

is attached

City

State

ZIP code

County of residence

If the decedent was a nonresident of New York State on the date of death, mark an X in this box and attach completed

Form ET‑141, New York State Estate Tax Domicile Affidavit ....................................................................................................

Executor - If you are submitting Letters Testamentary or Letters of Administration with this form, indicate in this box

the type of letters. Enter L if regular, LL if limited letters. If you are not submitting letters with this form, enter N.

Attorney’s or authorized representative’s last name

First name MI

Executor’s last name

First name

Middle initial

Mark an X

if POA is

attached

In care of

(firm’s name)

If more than one executor, mark an X in the box

(see instructions)

Address of attorney or authorized representative

Address of executor

City

State

ZIP code

City

State

ZIP code

SSN or PTIN of attorney or authorized rep.

Telephone number

Social security number of executor

Telephone number

(

)

(

)

E‑mail address of attorney or authorized representative

E‑mail address of executor

Estimated value of all assets of estate

(include jointly held assets)

Was the decedent a member

1

Real property

....

(including property located outside New York State)

of a partnership?

Yes

No

2

All other property ........................................................................

Did the decedent have a

Total

................................................................

3

(add lines 1 and 2)

surviving spouse?

Yes

No

Note: The executor may be held personally liable for unpaid estate

Mail this form with Form(s) ET‑117 to:

tax up to the value of the assets that were distributed before the

NYS ESTATE TAX

New York State estate tax was paid in full. The surviving spouse,

PROCESSING CENTER

all beneficiaries, and any other person in possession of property

PO BOX 15167

included in the New York gross estate may be held personally liable

ALBANY NY 12212-5167

for unpaid estate tax up to the value of property received from the

Private delivery services

estate (NYS Tax Law section 975).

If you choose, you may use a private delivery service, instead of the

A release(s) of lien is requested

(mark an X in the box).

U.S. Postal Service, to mail in your form and tax payment. However,

if, at a later date, you need to establish the date you filed or paid your

To obtain a release of lien, attach the following:

tax, you cannot use the date recorded by a private delivery service

unless you used a delivery service that has been designated by

1. A completed Form(s) ET‑117, Release of Lien of Estate Tax:

the U.S. Secretary of the Treasury or the Commissioner of Taxation

a. for each county in which real property is located; and/or

and Finance. (Currently designated delivery services are listed in

b. for each cooperative apartment.

Publication 55, Designated Private Delivery Services. See Need help?

on the next page for information on obtaining forms and publications.)

Enter the number of counties in which the properties are

If you have used a designated private delivery service and need to

located.

establish the date you filed your form, contact that private delivery

service for instructions on how to obtain written proof of the date

2. An original or verified copy of the Letters Testamentary or the

your form was given to the delivery service for delivery. If you use any

Letters of Administration, unless previously submitted (also

private delivery service, whether it is a designated service or not, send

indicate the type of letters in the section marked Executor,

the forms covered by these instructions to: State Processing Center,

above). Your application will not be processed until the letters of

431C Broadway, Albany NY 12204‑4836.

appointment are on file with the Tax Department.

3. A copy of the death certificate.

Note: A release of lien is not required if the real property was held

jointly by the decedent and the surviving spouse as the only joint

tenants. There is no fee for a release of lien.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2