Form Et-415 - Application For Deferred Payment Of Estate Tax

ADVERTISEMENT

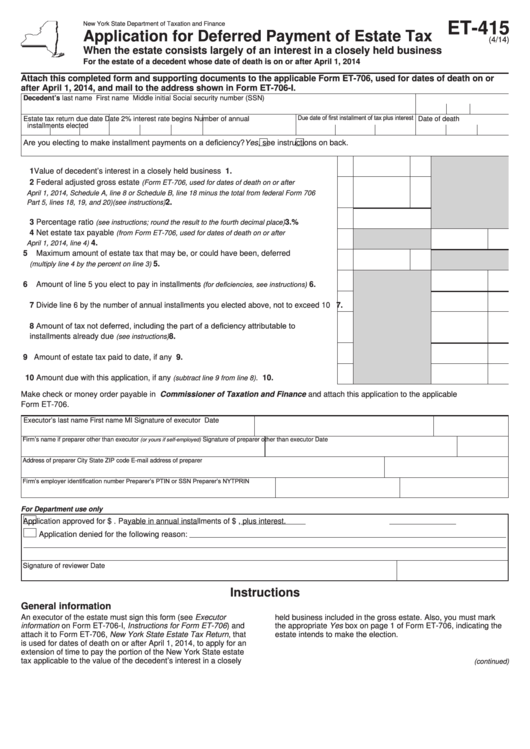

ET-415

New York State Department of Taxation and Finance

Application for Deferred Payment of Estate Tax

(4/14)

When the estate consists largely of an interest in a closely held business

For the estate of a decedent whose date of death is on or after April 1, 2014

Attach this completed form and supporting documents to the applicable Form ET-706, used for dates of death on or

after April 1, 2014, and mail to the address shown in Form ET-706-I.

Decedent’s last name

First name

Middle initial

Social security number (SSN)

Due date of first installment of tax plus interest

Estate tax return due date

Date 2% interest rate begins Number of annual

Date of death

installments elected

Are you electing to make installment payments on a deficiency? ......

Yes

No ........ If Yes, see instructions on back.

1 Value of decedent’s interest in a closely held business ..................................................

1.

2 Federal adjusted gross estate

(Form ET-706, used for dates of death on or after

April 1, 2014, Schedule A, line 8 or Schedule B, line 18 minus the total from federal Form 706

....................................................................

2.

Part 5, lines 18, 19, and 20) (see instructions)

3 Percentage ratio

.....................

3.

%

(see instructions; round the result to the fourth decimal place)

4 Net estate tax payable

(from Form ET-706, used for dates of death on or after

.........................................................................................................

4.

April 1, 2014, line 4)

5 Maximum amount of estate tax that may be, or could have been, deferred

............................................................................

5.

(multiply line 4 by the percent on line 3)

(for deficiencies, see instructions)

6 Amount of line 5 you elect to pay in installments

...........

6.

7 Divide line 6 by the number of annual installments you elected above, not to exceed 10

7.

8 Amount of tax not deferred, including the part of a deficiency attributable to

installments already due

....................................................................

8.

(see instructions)

9 Amount of estate tax paid to date, if any .........................................................................

9.

10 Amount due with this application, if any

. .................................. 10.

(subtract line 9 from line 8)

Make check or money order payable in U.S. funds to Commissioner of Taxation and Finance and attach this application to the applicable

Form ET-706.

Executor’s last name

First name

MI

Signature of executor

Date

Firm’s name if preparer other than executor

Signature of preparer other than executor

Date

(or yours if self-employed)

Address of preparer

City

State

ZIP code

E-mail address of preparer

Firm’s employer identification number

Preparer’s PTIN or SSN

Preparer’s NYTPRIN

For Department use only

Application approved for $

. Payable in

annual installments of $

, plus interest.

Application denied for the following reason:

Signature of reviewer

Date

Instructions

General information

An executor of the estate must sign this form (see Executor

held business included in the gross estate. Also, you must mark

information on Form ET-706-I, Instructions for Form ET-706) and

the appropriate Yes box on page 1 of Form ET-706, indicating the

attach it to Form ET-706, New York State Estate Tax Return, that

estate intends to make the election.

is used for dates of death on or after April 1, 2014, to apply for an

extension of time to pay the portion of the New York State estate

tax applicable to the value of the decedent’s interest in a closely

(continued)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3