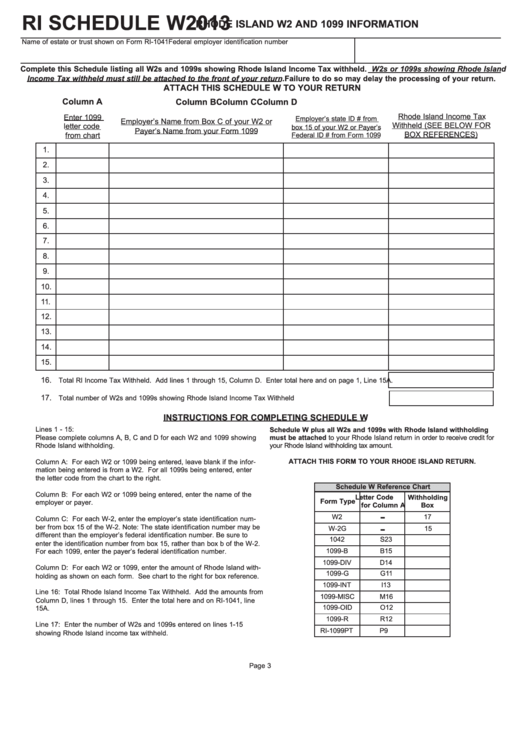

RI SCHEDULE W

2013

RHODE ISLAND W2 AND 1099 INFORMATION

Name of estate or trust shown on Form RI-1041

Federal employer identification number

Complete this Schedule listing all W2s and 1099s showing Rhode Island Income Tax withheld. W2s or 1099s showing Rhode Island

Income Tax withheld must still be attached to the front of your return. Failure to do so may delay the processing of your return.

ATTACH THIS SCHEDULE W TO YOUR RETURN

Column A

Column B

Column D

Column C

Rhode Island Income Tax

Enter 1099

Employer’s state ID # from

Employer’s Name from Box C of your W2 or

Withheld (SEE BELOW FOR

letter code

box 15 of your W2 or Payer’s

Payer’s Name from your Form 1099

BOX REFERENCES)

from chart

Federal ID # from Form 1099

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

Total RI Income Tax Withheld. Add lines 1 through 15, Column D. Enter total here and on page 1, Line 15A.

17.

Total number of W2s and 1099s showing Rhode Island Income Tax Withheld ...................................................

INSTRUCTIONS FOR COMPLETING SCHEDULE W

Lines 1 - 15:

Schedule W plus all W2s and 1099s with Rhode Island withholding

Please complete columns A, B, C and D for each W2 and 1099 showing

must be attached to your Rhode Island return in order to receive credit for

Rhode Island withholding.

your Rhode Island withholding tax amount.

ATTACH THIS FORM TO YOUR RHODE ISLAND RETURN.

Column A: For each W2 or 1099 being entered, leave blank if the infor-

mation being entered is from a W2. For all 1099s being entered, enter

the letter code from the chart to the right.

Schedule W Reference Chart

Column B: For each W2 or 1099 being entered, enter the name of the

Letter Code

Withholding

Form Type

employer or payer.

for Column A

Box

-

W2

17

Column C: For each W-2, enter the employer’s state identification num-

-

ber from box 15 of the W-2. Note: The state identification number may be

W-2G

15

different than the employer’s federal identification number. Be sure to

1042

S

23

enter the identification number from box 15, rather than box b of the W-2.

1099-B

B

15

For each 1099, enter the payer’s federal identification number.

1099-DIV

D

14

Column D: For each W2 or 1099, enter the amount of Rhode Island with-

1099-G

G

11

holding as shown on each form. See chart to the right for box reference.

1099-INT

I

13

Line 16: Total Rhode Island Income Tax Withheld. Add the amounts from

1099-MISC

M

16

Column D, lines 1 through 15. Enter the total here and on RI-1041, line

1099-OID

O

12

15A.

1099-R

R

12

Line 17: Enter the number of W2s and 1099s entered on lines 1-15

RI-1099PT

P

9

showing Rhode Island income tax withheld.

Page 3

1

1