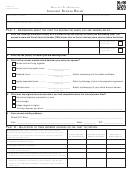

Form 454-N

Instructions for Simplified Nontaxable Affidavit

Revised 5-2008

Who can use this affidavit:

Only estates with a net estate value of less than the applicable exemption. If any property from the decedent’s estate

passes to a collateral heir and the date of death is prior to January 1, 2007, this affidavit cannot be used. If there is an

additional tax imposed to absorb the Federal credit, Form 454 must be used.

Examples of heirs:

Lineal: Decedent’s parents, children, step-children, grandchildren and great grandchildren.

Collateral: Decedent’s step-parents, brother, sister, aunt, uncle, step-grandchildren, nephew, niece, and others.

Timely Filing Required:

A completed affidavit and supporting schedules is due within 9 months of the date of the decedent’s death. An extension

of time to file, if requested in writing, may be granted for a period not to exceed 6 months. The request for the extension

must be made before the expiration of the normal 9 month filing period. Interest begins to accrue on any tax unpaid after

the 9 month due date. An extension does not affect the date that tax is due or the date that interest begins to accrue.

For deaths prior to January 1, 1999, the lineal exemption amount is $175,000.

Lineal Exemptions only:

For Deaths On or After

&

Before

Exemption Amount

January 1, 1999 ..................................... January 1, 2000 ..................... $ 275,000

January 1, 2000 ..................................... January 1, 2001 ..................... $ 475,000

January 1, 2001 ..................................... January 1, 2002 ..................... $ 675,000

January 1, 2002 ..................................... January 1, 2004 ..................... $ 700,000

January 1, 2004 ..................................... January 1, 2005 ..................... $ 850,000

January 1, 2005 ..................................... January 1, 2006 ..................... $ 950,000

January 1, 2006 ..................................... January 1, 2007 ..................... $1,000,000

Collateral and Lineal Exemptions:

For Deaths On or After

&

Before

Exemption Amount

January 1, 2007 ..................................... January 1, 2008 ..................... $1,000,000

January 1, 2008 ..................................... January 1, 2009 ..................... $2,000,000

January 1, 2009 ..................................... January 1, 2010 ..................... $3,000,000

There is no filing requirement for deaths occuring on or after January 1, 2010.

Cost Basis Adjustment:

In order for this affidavit to establish a stepped-up cost basis for certain property of the estate, a separate schedule

itemizing each asset type is required.

Alternate Valuation:

If the Alternate Valuation Election is made, all real estate, gas, oil, minerals, stocks and bonds, and all tangible personal

property must be valued as of 6 months after the date of death. This election does not affect the value of any accrued

rents or the value of growing crops.

The estate tax release will be mailed to the attorney (or preparer) as listed on the affidavit. If none is listed, it will be

mailed to the affiant.

If you have Estate Tax questions, please call (405) 521-3237 and ask for the Auditor of the Day.

1

1 2

2 3

3 4

4