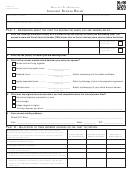

Form 454-N

Instructions for Simplified Nontaxable Affidavit, continued

Revised 5-2008

Line 1: Real Estate, Oil, Gas or Minerals:

Real Estate is to be stated at fair market value as of the date of death (or the alternate valuation date if so elected).

Include the value of the decedent’s interest if jointly owned. Mortgages against the real estate should be listed on line 15.

Growing crops are to be included at the date of death value regardless of the alternate valuation date election. If the

decedent was the recipient of a life interest from someone else, include that property at -0- value.

Oil, gas or mineral leases, rentals, royalties and leasehold interest in the State of Oklahoma is also listed here. In the

absence of an appraisal by a geologist or petroleum engineer, the minimum value to be reported is:

a. Producing minerals: except as noted, oil income should be valued at 48 times the average monthly income for the

six months before to six months after the date of death. Gas income should be valued at 84 times the average

monthly income for the six months prior to and six months after death. The Oklahoma Tax Commission shall not

be bound by the submitted evaluation.

1

b. Non-producing leased: the value should be 1

/

times the lease bonus if the lease was made within 1 year of the

2

date of death.

c. Non-producing non-leased: these values can be obtained by calling the Estate Tax Section of the Oklahoma Tax

Commission.

Line 2: Stocks and Bonds:

Include all stocks and bonds at full market value as of the date of death or alternate valuation date. Also include the value

of any sole proprietorship on this line. Joint tenancy property must be listed at full value unless the surviving joint tenant’s

interest is by documentation of contributions made with funds separate from the decedent’s. The documentation must be

accompanied by a sworn affidavit from the surviving joint tenant which sets forth the facts and supports the claim [Title 68

O.S. Sec 807(A)(4).]

Examples of exempt bonds may be found on the Estate Tax Return Form 454 which is available on our website. Other

bonds may be exempt. Refer to statutes cited on the face of the bonds issued.

Line 3: Personal Property - tangible and intangible:

Intangible personal property follows the domicile of the decedent, except for any intangibles used in connection with an

established business with a situs in this state. See [Title 68 O.S., Sec 807(7)] for more information. Intangible personal

property includes: cash on hand or on deposit, notes, mortgages, accounts receivable, contracts of sale and decedent’s

interest in partnerships located both within and without the State of Oklahoma. See 710:35-5-1 for rules concerning the

reporting of wrongful death claims.

Line 4: Life Insurance:

Include the amount actually paid by the insurance company. Also include all life insurance policies upon which the dece-

dent owned any interest on the life of someone else.

Line 5: Transfers During Life Time:

Include the value of all transfer of property, real, personal, or mixed, or any interest therein, made by the decedent which

were intended to take effect in possession or enjoyment at or after death, regardless of the date of transfer. Also include

the value of all transfer of property, real, personal, or mixed, or any interest therein, either in trust or by deed, bargain, sale

or gift, where such transfers were made without any equivalent in monetary consideration, within 3 years of the date of

death.

Line 7: Property out-of-state:

Include the gross value of all real estate, or any interest therein, and all personal property having a taxable situs outside of

the State of Oklahoma. Personal property is taxable in the state of domicile. Debts and mortgages should be listed on line

15. The value of the property is required only for the purpose of arriving at the percentage deduction and exemption

allowed by statute.

Line 12: Burial Plot, Crypt Mausoleum and Monument Expenses:

Monuments are limited to $500, burial plots, crypts or mausoleums are limited to $1,000.

1

1 2

2 3

3 4

4