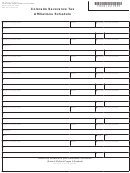

Reset Form

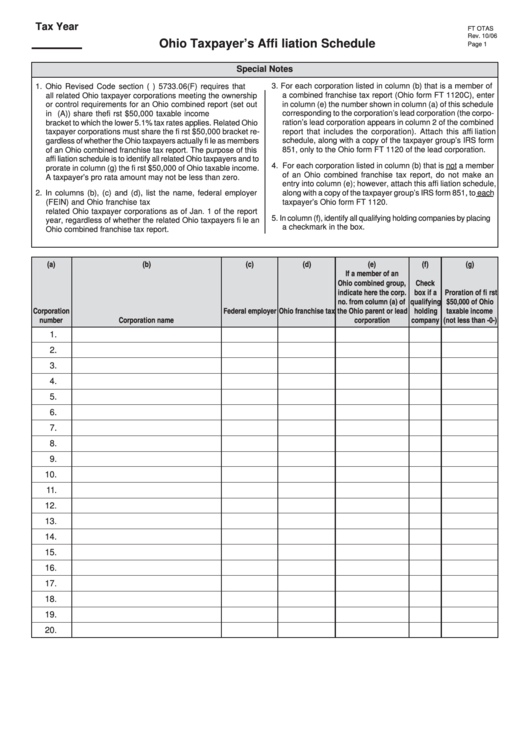

Tax Year

FT OTAS

Rev. 10/06

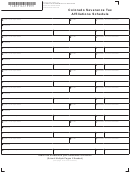

Ohio Taxpayer’s Affi liation Schedule

Page 1

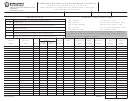

Special Notes

1. Ohio Revised Code section (R.C.) 5733.06(F) requires that

3. For each corporation listed in column (b) that is a member of

all related Ohio taxpayer corporations meeting the ownership

a combined franchise tax report (Ohio form FT 1120C), enter

or control requirements for an Ohio combined report (set out

in column (e) the number shown in column (a) of this schedule

in R.C. 5733.052(A)) share the fi rst $50,000 taxable income

corresponding to the corporation’s lead corporation (the corpo-

bracket to which the lower 5.1% tax rates applies. Related Ohio

ration’s lead corporation appears in column 2 of the combined

taxpayer corporations must share the fi rst $50,000 bracket re-

report that includes the corporation). Attach this affi liation

gardless of whether the Ohio taxpayers actually fi le as members

schedule, along with a copy of the taxpayer group’s IRS form

of an Ohio combined franchise tax report. The purpose of this

851, only to the Ohio form FT 1120 of the lead corporation.

affi liation schedule is to identify all related Ohio taxpayers and to

4. For each corporation listed in column (b) that is not a member

prorate in column (g) the fi rst $50,000 of Ohio taxable income.

of an Ohio combined franchise tax report, do not make an

A taxpayer’s pro rata amount may not be less than zero.

entry into column (e); however, attach this affi liation schedule,

2. In columns (b), (c) and (d), list the name, federal employer

along with a copy of the taxpayer group’s IRS form 851, to each

I.D. number (FEIN) and Ohio franchise tax I.D. number of all

taxpayer’s Ohio form FT 1120.

related Ohio taxpayer corporations as of Jan. 1 of the report

5. In column (f), identify all qualifying holding companies by placing

year, regardless of whether the related Ohio taxpayers fi le an

a checkmark in the box.

Ohio combined franchise tax report.

(a)

(b)

(c)

(d)

(e)

(f)

(g)

If a member of an

Ohio combined group,

Check

indicate here the corp.

box if a

Proration of fi rst

no. from column (a) of

qualifying

$50,000 of Ohio

Corporation

Federal employer

Ohio franchise tax

the Ohio parent or lead

holding

taxable income

number

Corporation name

I.D. number

I.D. number

corporation

company

(not less than -0-)

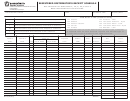

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

1

1 2

2