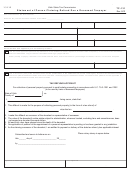

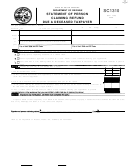

Form 507 - page 2

Statement of Person Claiming an Income Tax Return Due a Deceased Taxpayer

General Instructions

Purpose of Form...

If a refund check was issued, use Form 507 to claim an income tax refund on behalf of a deceased taxpayer. The original

refund check should be returned with this form. Your name will be added to the refund check and the check will be reissued.

If the refund was issued on a debit card, do not use Form 507. Do not send the debit card to the Oklahoma Tax Commis-

sion. You must contact ACS, the vendor for the debit card, for instructions on how to obtain the refund. Contact ACS at

1-888-929-2460. See the Debit Card FAQ “What should I do if I receive a debit card for a deceased taxpayer?” located on

our website at

Who Must File...

If you are claiming an income tax refund on behalf of a deceased taxpayer, you must file Form 507 unless any of the fol-

lowing applies:

•

You are a surviving spouse filing an original or amended joint return with the decedent, OR

•

You are a personal representative filing an Oklahoma income tax return for the decedent. If a refund check was

issued in the name of the decedent, it may be cashed with the endorsement of the personal representative.

•

The refund was issued on a debit card.

Personal Representative...

For purposes of this form, a personal representative is the executor or administrator of the decedent’s estate, as certified

or appointed by the court. A copy of the decedent’s will cannot be accepted as evidence that you are the personal repre-

sentative.

Specific Instructions

File Form 507 after the decedent’s income tax return has been submitted. Do not file this form with the decedent’s income

tax return. Return the original refund check with this form. Mail Form 507, the original refund check and any required

documentation to:

Oklahoma Tax Commission

Post Office Box 269057

Oklahoma City, OK 73126-9057

A new check will be issued in your name along with the decedent’s.

Part 1

Line A

Check the box on line A only if you are the decedent’s court-appointed personal representative claiming a refund for the

decedent on an Oklahoma income tax return. You must attach a copy of the court order showing your appointment. If

you have already sent the court order to the Oklahoma Tax Commission, complete Form 507 and write “Order Previously

Filed” at the bottom of the form.

Line B

Check the box on line B if you are not a surviving spouse claiming a refund based on a joint return and there is no court-

appointed personal representative. You must also complete Part 2.

If you check the box on line B, you must attach proof of death.

The proof of death must be an original or certified copy of either of the following:

•

The death certificate, or

•

The formal notification from the appropriate government office (for example, Department of Defense) informing

the next of kin of the decedent’s death.

Example. Your father died on August 25. You are his sole survivor. Your father did not have a will and the court did not

appoint a personal representative for his estate. Your father is entitled to a $300 refund for which a check was issued. To

claim the refund, you must complete Form 507. You should check the box in Part 1, on line B, of Form 507, answer all the

questions in Part 2, and sign your name in Part 3. You must also attach a copy of the death certificate or other proof of

death. Your name will be added to the refund check.

Part 2

Lines 1-3

If you checked the box on Part 1, line B, you must complete Part 2, lines 1 through 3.

1

1 2

2