Sales And Use Tax Return - City Of Golden Page 2

ADVERTISEMENT

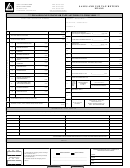

USE TAX

The Golden Municipal Code imposes a tax upon the privelege of using, storing, distributing or otherwise consuming in the City tangible prop-

erty or taxable services purchased, rented or leased.

A credit is given for taxes paid to other municipalities if the property was not delivered to the business in Golden.

SCHEDULE A:

CITY USE TAX AT 3%

For purchases where no city tax was paid

Date of Purchase

Name of Vendor/Address

Type of Commodity Purchased

Purchase Price

Total Purchase Price of Property subject to City 3% Use Tax

$

.

Enter here and on line 10A of return

Total tax at 3%

$

.

SCHEDULE B:

CITY USE TAX AT < 3%

For purchases where city tax of less than 3% was paid

Date of Purchase

Name of Vendor/Address

Type of Commodity Purchased

Purchase Price

Total Purchase Price of Property subject to City 3% Use Tax

$

.

Total tax at 3%

$

.

Credit for taxes paid to other municipalities Tax Credit

$

.

Total tax at varying rates < 3%

$

.

Enter here and on line 10B of return

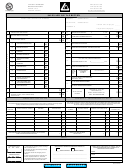

SCHEDULE C:

CONSOLIDATED ACCOUNTS REPORTS

This schedule is required in all cases in which the taxpayer makes a consolidated return which includes sales made at more than one location. It must be completely

filled out and convey all information required in accordance with the column heading. If additional space is needed, attach a schedule in the same format.

Account Number

Business Address of Consolidated Accts.

Period’s Total Gross Sales

Period’s Net Taxable Sales

Period’s Use Tax

(aggregate to line 1, front of return)

(aggregate to line 4, front of return)

(aggregate to line 10A/B of return)

Aggregate Totals

$

.

$

.

$

.

New Business Date

Show change of ownership and/or business address:

Mo

Day

Year

Discontinued Date

MAILING ADDRESS (Check if different

Mo

Day

Year

and show address for notices)

1

If ownership has changed, give date of change and new owner’s name

2

If business has been permanently discontinued, give date discontinued

3

If business location has changed, give new address

4

Records are kept at what address?

5

If business is temporarily closed, give dates to be closed

6

If business is seasonal, give month(s) of operation

7

If the return includes sales for more than one location, refer to and complete Schedule C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2