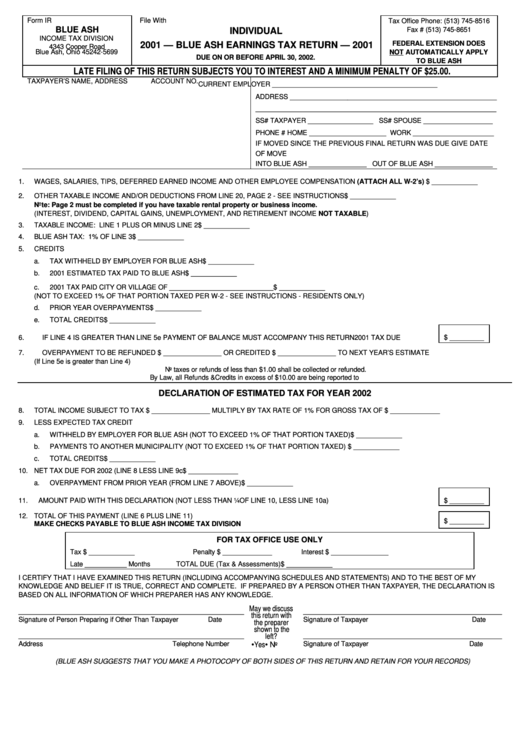

Form IR

File With

Tax Office Phone: (513) 745-8516

BLUE ASH

Fax # (513) 745-8651

INDIVIDUAL

INCOME TAX DIVISION

FEDERAL EXTENSION DOES

2001 — BLUE ASH EARNINGS TAX RETURN — 2001

4343 Cooper Road

NOT AUTOMATICALLY APPLY

Blue Ash, Ohio 45242-5699

DUE ON OR BEFORE APRIL 30, 2002.

TO BLUE ASH

LATE FILING OF THIS RETURN SUBJECTS YOU TO INTEREST AND A MINIMUM PENALTY OF $25.00.

TAXPAYER’S NAME, ADDRESS

ACCOUNT NO.

CURRENT EMPLOYER ___________________________________________

ADDRESS ______________________________________________________

_______________________________________________________________

SS# TAXPAYER _________________ SS# SPOUSE __________________

PHONE # HOME ____________________ WORK _____________________

IF MOVED SINCE THE PREVIOUS FINAL RETURN WAS DUE GIVE DATE

OF MOVE

INTO BLUE ASH _______________ OUT OF BLUE ASH _______________

1.

WAGES, SALARIES, TIPS, DEFERRED EARNED INCOME AND OTHER EMPLOYEE COMPENSATION (ATTACH ALL W-2’s) ..... $ ____________

2.

OTHER TAXABLE INCOME AND/OR DEDUCTIONS FROM LINE 20, PAGE 2 - SEE INSTRUCTIONS ............... ................................ $ ____________

Note: Page 2 must be completed if you have taxable rental property or business income.

(INTEREST, DIVIDEND, CAPITAL GAINS, UNEMPLOYMENT, AND RETIREMENT INCOME NOT TAXABLE)

3.

TAXABLE INCOME: LINE 1 PLUS OR MINUS LINE 2 .............................................................................................. ................................ $ ____________

4.

BLUE ASH TAX: 1% OF LINE 3.................................................................................................................................. ................................ $ ____________

5.

CREDITS

a.

TAX WITHHELD BY EMPLOYER FOR BLUE ASH............................................................................................$ ____________

b.

2001 ESTIMATED TAX PAID TO BLUE ASH .....................................................................................................$ ____________

c.

2001 TAX PAID CITY OR VILLAGE OF ___________________________ .......................................................$ ____________

(NOT TO EXCEED 1% OF THAT PORTION TAXED PER W-2 - SEE INSTRUCTIONS - RESIDENTS ONLY)

d.

PRIOR YEAR OVERPAYMENTS ........................................................................................................................$ ____________

e.

TOTAL CREDITS ................................................................................................................................................. ................................ $ ____________

6.

IF LINE 4 IS GREATER THAN LINE 5e PAYMENT OF BALANCE MUST ACCOMPANY THIS RETURN.............. 2001 TAX DUE........ $ _________

7.

OVERPAYMENT TO BE REFUNDED $ _______________ OR CREDITED $ _______________ TO NEXT YEAR’S ESTIMATE

(If Line 5e is greater than Line 4)

No taxes or refunds of less than $1.00 shall be collected or refunded.

By Law, all Refunds & Credits in excess of $10.00 are being reported to I.R.S.

DECLARATION OF ESTIMATED TAX FOR YEAR 2002

8.

TOTAL INCOME SUBJECT TO TAX $ _______________ MULTIPLY BY TAX RATE OF 1% FOR GROSS TAX OF ............................ $ _____________

9.

LESS EXPECTED TAX CREDIT

a.

WITHHELD BY EMPLOYER FOR BLUE ASH (NOT TO EXCEED 1% OF THAT PORTION TAXED) ............$ ____________

b.

PAYMENTS TO ANOTHER MUNICIPALITY (NOT TO EXCEED 1% OF THAT PORTION TAXED) ..............$ ____________

c.

TOTAL CREDITS .................................................................................................................................................$ ____________

10. NET TAX DUE FOR 2002 (LINE 8 LESS LINE 9c....................................................................................................... ................................ $ _____________

a.

OVERPAYMENT FROM PRIOR YEAR (FROM LINE 7 ABOVE).......................................................................$ ____________

11. AMOUNT PAID WITH THIS DECLARATION (NOT LESS THAN ¼ OF LINE 10, LESS LINE 10a)

$ _________

12. TOTAL OF THIS PAYMENT (LINE 6 PLUS LINE 11)

MAKE CHECKS PAYABLE TO BLUE ASH INCOME TAX DIVISION....................................................................... ................................ $ _________

FOR TAX OFFICE USE ONLY

Tax $ ____________

Penalty $ _____________

Interest $ _______________

Late ___________ Months

TOTAL DUE (Tax & Assessments) ....................................................................$ ____________

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY

KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THE DECLARATION IS

BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

May we discuss

___________________________________________________________

____________________________________________________

this return with

Signature of Person Preparing if Other Than Taxpayer

Date

Signature of Taxpayer

Date

the preparer

shown to the

left?

___________________________________________________________

____________________________________________________

•

Yes

•

No

Address

Telephone Number

Signature of Taxpayer

Date

(BLUE ASH SUGGESTS THAT YOU MAKE A PHOTOCOPY OF BOTH SIDES OF THIS RETURN AND RETAIN FOR YOUR RECORDS)

1

1 2

2