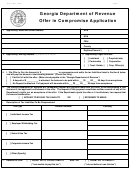

Form De 999a - Offer In Compromise Application - 1999 Page 4

ADVERTISEMENT

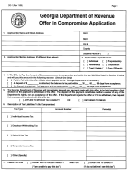

Terms of Rescission

Specific Instructions

The acceptance of the offer will be rescinded and all

1. The offer must be submitted on an “Offer in

compromised liabilities will be reestablished without

Compromise” application. A separate application

regard to any statute of limitations if it is subsequently

must be submitted for each account to be

determined that any individual(s) willfully:

compromised.

1. Concealed from any officer or employee of the

2. The application must be completed and

State any property belonging to the estate of the

accompanied by Cash, Cashiers Check or Money

individual liable with respect to the tax.

Order equal to amount offered. If the full amount

cannot be paid at the time of offer, the individual

2. Received, withheld, destroyed, mutilated, or

may be permitted to pay the agreed amount in

falsified any books, document, or record.

installments, not to exceed a five-year period. The

Department will negotiate terms of the installment

3. Made any false statement relating to the estate or

plan during the review process.

financial conditions of the individual liable with

respect to the tax.

3. This is a legal and binding agreement and must be

read in its entirety. The application cannot be

4. Failed to pay any tax liability owed the Department

processed without signature in all applicable

for any subsequent, active business in which the

areas.

individual who previously submitted the offer in

compromise has a controlling interest or

4. Send original application to:

association.

Employment Development Department

Upon any rescission, the Department, at its discretion,

P.O. Box 826203, MIC 92S

may file a Notice of State Tax Lien against the

Sacramento, CA 94230-6203

individual or entity responsible for the previously

compromised liability.

5. Retain a copy for your records.

The Department will notify the individual who

Other Facts to Know

previously submitted the Offer in Compromise in

writing of the following:

The Offer in Compromise package must be completed.

You will be expected to provide reasonable

1. The rescission of any offer and reasons therefor.

documentation to verify your inability to pay the full

liability. The offer will only be successful if, a legitimate

2. The amount of liability that is due and payable.

proposal is submitted in the State’s best interests.

Collection Action

Should you have any questions, please contact the

Department at (916) 464-2726.

Submission of an offer does not automatically suspend

collection action on a liability. Should there be any

Public Disclosure

indication that filing the offer is solely for the purpose of

delaying collection or will negatively impact our ability

A statement will be placed on file with the Department

to collect the tax, collection efforts will continue. If the

for one year from the date the terms and conditions

Department has previously agreed to an installment

have been fulfilled. The statement will be available for

plan, those payments must continue.

public inspection; however, no lists will be distributed

by the Department in connection with these

Should collection action occur after an acceptance of

statements.

an Offer in Compromise, you may receive a refund or

have the funds applied to the agreed amount.

DE 999A (3-99) (INTERNET)

Page 4 of 4

CU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4